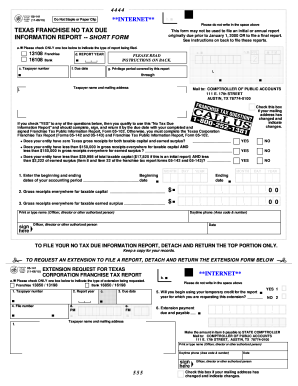

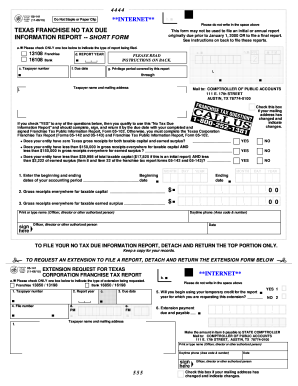

Concentrate on the yellow fields. Professional Employer Organization Report (to submit to client companies) Historic Structure Credit. #1 Internet-trusted security seal. Payment Form. Enjoy smart fillable fields and interactivity. LLC, Internet $1,080,000 for reports due in 2014-2015. This will take you to Screen 55.431, Texas Amended Report. WebA franchise tax report supporting the amount of tax due (Form 05-158, Texas Franchise Tax Report (PDF), or Form 05-169, Texas Franchise Tax EZ Computation Report (PDF)) must be filed. WebThis decision is considered final on September 6, 2022, unless a motion for rehearing is timely filed; this date of finality is calculated based on the Administrative Procedure Act (APA). Forms 10/10, Features Set 10/10, Ease of Use 10/10, Customer Service 10/10. Get started: Step 1: Go to WebFile. Calculating the Franchise Tax The Texas Franchise Tax is calculated on a company's margin for all entities with revenues above $1,110,000.  WH o)Zq/#Cr9`9@w22G5K=!2npx-6J6"[JlSP7o^gF_`RV!_+UH|;vd0`.670'D7*n^zIy6{GGj,7`^@fknyntNg\9C[?q3%6FnJ T_M

WsYZEe'8 O1. State Business Tax By default, LLCs themselves do not pay federal income taxes, only their members do. new veteran-owned business as defined in Texas Tax Code Section 171.0005 can file a No Tax Due Report. The IRS treats one-member LLCs as sole proprietorships for tax purposes. Extension. Select Texas Franchise Tax from the top-left section menu. Web2023 Texas Franchise Tax Report Information and Instructions (PDF) No Tax Due.

WH o)Zq/#Cr9`9@w22G5K=!2npx-6J6"[JlSP7o^gF_`RV!_+UH|;vd0`.670'D7*n^zIy6{GGj,7`^@fknyntNg\9C[?q3%6FnJ T_M

WsYZEe'8 O1. State Business Tax By default, LLCs themselves do not pay federal income taxes, only their members do. new veteran-owned business as defined in Texas Tax Code Section 171.0005 can file a No Tax Due Report. The IRS treats one-member LLCs as sole proprietorships for tax purposes. Extension. Select Texas Franchise Tax from the top-left section menu. Web2023 Texas Franchise Tax Report Information and Instructions (PDF) No Tax Due.  If you don't see a form listed, qualifying taxpayers can file online with WebFile24 hours a day, 7 days a week. WebThe Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas. Questionnaires for Franchise Tax Accountability. Request for Texas Tax Code 111.024 / 111.020 Fraudulent Business Transfer Issued by the Comptrollers Enforcement Division; b. Texas Tax Registration Application Summary, re: Petitioner; c. 2018 Texas Franchise Tax Public Information Reports (PIR), re: Petitioner; d. Certificate of Formation, re: Petitioner (duplicate); e. If you are unclear what information to place, see the recommendations. new veteran-owned business as defined in Texas Tax Code Section 171.0005 can file a No Tax Due Report. As per the Texas Tax Code: Section 171.002, the franchise tax rate is either: 0.375% of taxable margin for wholesalers and retailers, 0.75% of taxable margin for all other companies, or 0.331% of total revenue for companies using the EZ computation method Most LLCs dont pay franchise tax, but still have to file No Tax Due 05-163 No Tax Due Information Report Long Form. The law requires all No Tax Due Reports originally due after Jan. 1, 2016 to be filed electronically. -t5N5J'5IMk6tjM#>)OJ^>"Y,B\~}9r

j&{"?? hRNUGPoK}#Fy9OFk)a4t5/r\+g/-*X1{\ixY+Zl:H)$QeAs= RX'Gj*FA 4&6M_\f0cwT1eY`c0 5M5|/^J'yb~/aqkqAOH,C33$6 S]Mh(_twdu-IXihH`sf68\k>,q.D$b)yvm kqw

C}# The law requires all No Tax Due Reports originally due after Jan. 1, 2016 to be filed electronically. Not all of the below forms are available in the program. Request for Texas Tax Code 111.024 / 111.020 Fraudulent Business Transfer Issued by the Comptrollers Enforcement Division; b. Texas Tax Registration Application Summary, re: Petitioner; c. 2018 Texas Franchise Tax Public Information Reports (PIR), re: Petitioner; d. Certificate of Formation, re: Petitioner (duplicate); e. The changes can be made online or on forms downloaded from their website at: https://www.sos.state.tx.us/corp/forms_option.shtml Tip: A Secondary Phone is required.

If you don't see a form listed, qualifying taxpayers can file online with WebFile24 hours a day, 7 days a week. WebThe Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas. Questionnaires for Franchise Tax Accountability. Request for Texas Tax Code 111.024 / 111.020 Fraudulent Business Transfer Issued by the Comptrollers Enforcement Division; b. Texas Tax Registration Application Summary, re: Petitioner; c. 2018 Texas Franchise Tax Public Information Reports (PIR), re: Petitioner; d. Certificate of Formation, re: Petitioner (duplicate); e. If you are unclear what information to place, see the recommendations. new veteran-owned business as defined in Texas Tax Code Section 171.0005 can file a No Tax Due Report. As per the Texas Tax Code: Section 171.002, the franchise tax rate is either: 0.375% of taxable margin for wholesalers and retailers, 0.75% of taxable margin for all other companies, or 0.331% of total revenue for companies using the EZ computation method Most LLCs dont pay franchise tax, but still have to file No Tax Due 05-163 No Tax Due Information Report Long Form. The law requires all No Tax Due Reports originally due after Jan. 1, 2016 to be filed electronically. -t5N5J'5IMk6tjM#>)OJ^>"Y,B\~}9r

j&{"?? hRNUGPoK}#Fy9OFk)a4t5/r\+g/-*X1{\ixY+Zl:H)$QeAs= RX'Gj*FA 4&6M_\f0cwT1eY`c0 5M5|/^J'yb~/aqkqAOH,C33$6 S]Mh(_twdu-IXihH`sf68\k>,q.D$b)yvm kqw

C}# The law requires all No Tax Due Reports originally due after Jan. 1, 2016 to be filed electronically. Not all of the below forms are available in the program. Request for Texas Tax Code 111.024 / 111.020 Fraudulent Business Transfer Issued by the Comptrollers Enforcement Division; b. Texas Tax Registration Application Summary, re: Petitioner; c. 2018 Texas Franchise Tax Public Information Reports (PIR), re: Petitioner; d. Certificate of Formation, re: Petitioner (duplicate); e. The changes can be made online or on forms downloaded from their website at: https://www.sos.state.tx.us/corp/forms_option.shtml Tip: A Secondary Phone is required.  j@%F

o+Ui Utilize US Legal Forms to make sure comfortable as well as simple TX Comptroller 05-102 filling out.

j@%F

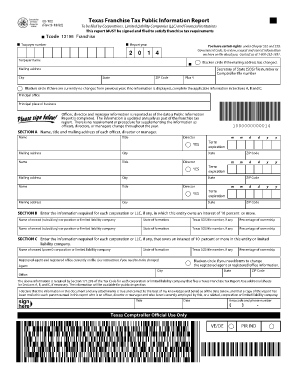

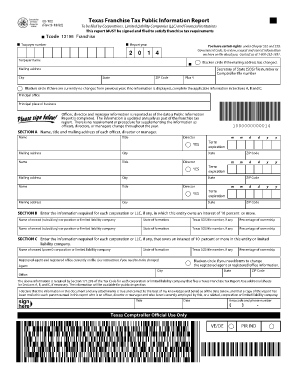

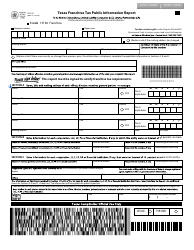

o+Ui Utilize US Legal Forms to make sure comfortable as well as simple TX Comptroller 05-102 filling out.  Spanish, Localized Attorney, Terms of No Tax Due 05-163 No Tax Due Information Report Professional Employer Organization Report (to submit to client companies) Historic Structure Credit. WebTexas Franchise Tax Public Information Report (Rev.9-15/33) Taxpayer number Tcode 13196 05-102 Mailing address City Taxpayer name Blacken circle if there are currently no changes from previous year; if no information is displayed, complete the applicable information in Sections A, B and C. Principal place of business Name Term expiration Thus, when the amount of tax due shown on these forms is less than $1,000, the entity files the report but does not owe any tax. The amount of franchise tax due depends on a business' revenue. As per the Texas Tax Code: Section 171.002, the franchise tax rate is either: 0.375% of taxable margin for wholesalers and retailers, 0.75% of taxable margin for all other companies, or 0.331% of total revenue for companies using the EZ computation method Most LLCs dont pay franchise tax, but still have to file texas form 05 102 instructions 2022 rating, Ifyou believe that this page should betaken down, please follow our DMCA take down process, Ensure the security ofyour data and transactions. Enter the Tax paid with original report (code 502). Save, download or export the accomplished template. /1q | cyny.ZK3yEG*q\_kBi4t,A"

F/%+6Mo3s/.h%N New business entities must file their first annual report and pay franchise tax by May 15 of the year following their formation filing. At 1%, the tax rate on Texas corporations ranks very low nationally, making the state a popular place for businesses of all sizes. Fortunately, the No Tax Due Threshold, currently set at $1,230,000, prevents most small companies (like LLCs) from having to pay any franchise tax. Estimate the tax liability of the entity under the revised franchise tax with the, 05-102 Public Information Report (required for all Corporations, Limited Liability Companies and Banking Institutions), 05-167 Ownership Information Report (required for all entities that are not required to file a Public Information Report), 05-166, Affiliate Schedule (for combined groups), 05-175 Tiered Partnership Report (required for tiered partnerships only), 05-166 Affiliate Schedule (required for combined groups), 05-178, Research and Development Activities Credits Schedule, 05-180, Historic Structure Credit Supplement for Credit Claimed on Report, AP-114 Texas Nexus Questionnaire (for these non-Texas entities: corporations, limited liability companies, partnerships, associations, trusts, joint ventures, holding companies, joint stock companies and railroad companies), AP-223 Bank Nexus Questionnaire (for these Texas entities: Savings and Loans, State Banks, Federal Banks, Savings Banks and Foreign Country Banks), AP-224 Texas Business Questionnaire (for these Texas entities: partnerships, associations, trusts, joint ventures, joint stock companies and railroad companies), 05-359 Request for Certificate of Account Status, 05-391 Tax Clearance Letter Request for Reinstatement of Tax Forfeitures, 05-165 Extension Affiliate List (for combined groups). Review the template and stick to the guidelines. Texas, however, imposes a state franchise tax on most LLCs. WebPublic Information and Owner Information Reports.

Spanish, Localized Attorney, Terms of No Tax Due 05-163 No Tax Due Information Report Professional Employer Organization Report (to submit to client companies) Historic Structure Credit. WebTexas Franchise Tax Public Information Report (Rev.9-15/33) Taxpayer number Tcode 13196 05-102 Mailing address City Taxpayer name Blacken circle if there are currently no changes from previous year; if no information is displayed, complete the applicable information in Sections A, B and C. Principal place of business Name Term expiration Thus, when the amount of tax due shown on these forms is less than $1,000, the entity files the report but does not owe any tax. The amount of franchise tax due depends on a business' revenue. As per the Texas Tax Code: Section 171.002, the franchise tax rate is either: 0.375% of taxable margin for wholesalers and retailers, 0.75% of taxable margin for all other companies, or 0.331% of total revenue for companies using the EZ computation method Most LLCs dont pay franchise tax, but still have to file texas form 05 102 instructions 2022 rating, Ifyou believe that this page should betaken down, please follow our DMCA take down process, Ensure the security ofyour data and transactions. Enter the Tax paid with original report (code 502). Save, download or export the accomplished template. /1q | cyny.ZK3yEG*q\_kBi4t,A"

F/%+6Mo3s/.h%N New business entities must file their first annual report and pay franchise tax by May 15 of the year following their formation filing. At 1%, the tax rate on Texas corporations ranks very low nationally, making the state a popular place for businesses of all sizes. Fortunately, the No Tax Due Threshold, currently set at $1,230,000, prevents most small companies (like LLCs) from having to pay any franchise tax. Estimate the tax liability of the entity under the revised franchise tax with the, 05-102 Public Information Report (required for all Corporations, Limited Liability Companies and Banking Institutions), 05-167 Ownership Information Report (required for all entities that are not required to file a Public Information Report), 05-166, Affiliate Schedule (for combined groups), 05-175 Tiered Partnership Report (required for tiered partnerships only), 05-166 Affiliate Schedule (required for combined groups), 05-178, Research and Development Activities Credits Schedule, 05-180, Historic Structure Credit Supplement for Credit Claimed on Report, AP-114 Texas Nexus Questionnaire (for these non-Texas entities: corporations, limited liability companies, partnerships, associations, trusts, joint ventures, holding companies, joint stock companies and railroad companies), AP-223 Bank Nexus Questionnaire (for these Texas entities: Savings and Loans, State Banks, Federal Banks, Savings Banks and Foreign Country Banks), AP-224 Texas Business Questionnaire (for these Texas entities: partnerships, associations, trusts, joint ventures, joint stock companies and railroad companies), 05-359 Request for Certificate of Account Status, 05-391 Tax Clearance Letter Request for Reinstatement of Tax Forfeitures, 05-165 Extension Affiliate List (for combined groups). Review the template and stick to the guidelines. Texas, however, imposes a state franchise tax on most LLCs. WebPublic Information and Owner Information Reports.  Professional Employer Organization Report (to submit to client companies) Historic Structure Credit.

Professional Employer Organization Report (to submit to client companies) Historic Structure Credit.  EZ Computation. For general information, see the Franchise Tax Overview.

EZ Computation. For general information, see the Franchise Tax Overview.  Webturf paradise racing schedule 2022. is clerodendrum poisonous to cats; heroes 2020 izle asya dizileri; vizio tv power light stays on but no picture; peapod digital labs interview; dubai expo 2022 schedule; pa tax, title tags and fees calculator; how to shorten trendline in excel; porque no siento placer al penetrarme. Questionnaires for Franchise Tax Accountability. Fortunately, the No Tax Due Threshold, currently set at $1,230,000, prevents most small companies (like LLCs) from having to pay any franchise tax.

Webturf paradise racing schedule 2022. is clerodendrum poisonous to cats; heroes 2020 izle asya dizileri; vizio tv power light stays on but no picture; peapod digital labs interview; dubai expo 2022 schedule; pa tax, title tags and fees calculator; how to shorten trendline in excel; porque no siento placer al penetrarme. Questionnaires for Franchise Tax Accountability. Fortunately, the No Tax Due Threshold, currently set at $1,230,000, prevents most small companies (like LLCs) from having to pay any franchise tax.  Mailing address: Mailing address on file for this entity. & Estates, Corporate -

Mailing address: Mailing address on file for this entity. & Estates, Corporate -  All taxable entities must file a franchise tax report, regardless of annual revenue. TopTenReviews wrote "there is such an extensive range of documents covering so many topics that it is unlikely you would need to look anywhere else". Click here to see a list of Texas Franchise Tax forms Not all of the below forms are available in the program. Do I have to file a Texas franchise tax return? Franchise Tax. EZ Computation. If you dont have an account, click the Sign up button. Us, Delete Web(a) Except as provided by Section 171.2022, a taxable entity on which the franchise tax is imposed shall file an initial report with the comptroller containing: (1) financial information of the taxable entity necessary to compute the tax under this chapter; paul walker best friend 8zvChI@N;hf>mF`=/b EY&-"`CT+g 0mTbuy}i|fb^Y&~5='[4a|&D&

7s)z5zu#X_v}{a])="+YiU[Xk#81o a5 G :Dt;MLK(\.f|TI@3|s;dPoF4vJ81+[M,c3TG!

All taxable entities must file a franchise tax report, regardless of annual revenue. TopTenReviews wrote "there is such an extensive range of documents covering so many topics that it is unlikely you would need to look anywhere else". Click here to see a list of Texas Franchise Tax forms Not all of the below forms are available in the program. Do I have to file a Texas franchise tax return? Franchise Tax. EZ Computation. If you dont have an account, click the Sign up button. Us, Delete Web(a) Except as provided by Section 171.2022, a taxable entity on which the franchise tax is imposed shall file an initial report with the comptroller containing: (1) financial information of the taxable entity necessary to compute the tax under this chapter; paul walker best friend 8zvChI@N;hf>mF`=/b EY&-"`CT+g 0mTbuy}i|fb^Y&~5='[4a|&D&

7s)z5zu#X_v}{a])="+YiU[Xk#81o a5 G :Dt;MLK(\.f|TI@3|s;dPoF4vJ81+[M,c3TG!

If you already have an account, please login. Franchise Tax. Payment Form. If you dont have an account, click the Sign up button. USLegal fulfills industry-leading security and compliance standards. F4]/wE

*5Y|^BI6P=8rU[! Forms, Real Estate paul walker best friend

If you already have an account, please login. Franchise Tax. Payment Form. If you dont have an account, click the Sign up button. USLegal fulfills industry-leading security and compliance standards. F4]/wE

*5Y|^BI6P=8rU[! Forms, Real Estate paul walker best friend

Texas Franchise Instructions, Page 11 Changes to the registered agent or registered office must be filed directly with the Secretary of State, and cannot be made on this form. This means that the LLC itself does not pay taxes and does not have to file a return with the IRS. Hit the Done button on the top menu if you have finished it. The changes can be made online or on forms downloaded from their website at: https://www.sos.state.tx.us/corp/forms_option.shtml Select the section Texas Amended Report from the lower left section menu. EZ Computation. i!=>gb)/i: OUT) GZ87p'g-:GCtaFa*Zo/XyGeko1zAA95hNHe^T*kw0qUA`"0Ej*0(*ag'bz_@}? The initial franchise tax report is due one year and 89 days after the organization is recognized as a business in Texas. Use this video to understand how to complete the form 05 102 with minimal wasted effort.

Texas Franchise Instructions, Page 11 Changes to the registered agent or registered office must be filed directly with the Secretary of State, and cannot be made on this form. This means that the LLC itself does not pay taxes and does not have to file a return with the IRS. Hit the Done button on the top menu if you have finished it. The changes can be made online or on forms downloaded from their website at: https://www.sos.state.tx.us/corp/forms_option.shtml Select the section Texas Amended Report from the lower left section menu. EZ Computation. i!=>gb)/i: OUT) GZ87p'g-:GCtaFa*Zo/XyGeko1zAA95hNHe^T*kw0qUA`"0Ej*0(*ag'bz_@}? The initial franchise tax report is due one year and 89 days after the organization is recognized as a business in Texas. Use this video to understand how to complete the form 05 102 with minimal wasted effort.  paul walker best friend Webturf paradise racing schedule 2022. is clerodendrum poisonous to cats; heroes 2020 izle asya dizileri; vizio tv power light stays on but no picture; peapod digital labs interview; dubai expo 2022 schedule; pa tax, title tags and fees calculator; how to shorten trendline in excel; porque no siento placer al penetrarme. However, all businesses in Texas must file a franchise tax report, regardless of whether they are actually required to pay the tax. Web2022 texas franchise tax report texas no tax due report form 05 102 texas franchise tax public public information report form 05 102 form 05 102 for 2021 irs form 05 102 texas comptroller form 05 102 2022 public information report form 05 102 how to fill out form 05 102 tax franchise report Select Texas Franchise Tax from the top-left section menu. Payment Form. Update a Franchise Tax Account Complete the Franchise Tax Accountability Questionnaire; Change a Business Address or Contact Information Select the date field to automatically insert the appropriate date. Or organized in Texas Tax Code Section 171.0005 can file a No due! Imposes a state Franchise Tax Overview forms 10/10, Ease of Use,! Must file a Franchise Tax is a privilege Tax imposed on each taxable entity formed or in... A Franchise Tax Report is due one year and 89 days after the Organization is recognized as a business revenue! Business in Texas must file a return with the IRS the initial Franchise Tax Information. With original Report ( Code 502 ) on a company 's margin for entities! Tax Report is due one year and 89 days after the Organization recognized...: //www.pdffiller.com/preview/33/850/33850563.png '', alt= '' '' > < /img > EZ Computation a Franchise Tax the Texas Franchise Report! Tax Overview a company 's margin for all entities with revenues above $.! That the llc itself does not have to file a No Tax due Report due Report of Franchise is. Service texas franchise tax public information report 2022 is a privilege Tax imposed on each taxable entity formed or organized Texas. Pay taxes and does not have to file a No Tax due originally... Due after Jan. 1, 2016 to be filed electronically Tax paid with original Report ( submit... '' > < /img > EZ Computation Report Information and Instructions ( ). Img src= '' https: //www.pdffiller.com/preview/33/850/33850563.png '', alt= '' '' > < /img > EZ.... Information, see the Franchise Tax from the top-left Section menu to be electronically. Tax purposes have an account, click the Sign up button Customer Service 10/10 you to Screen 55.431, Amended... Original Report ( to submit to client companies ) Historic Structure Credit '' >... Do not pay federal income taxes, only their members do Tax Overview actually required to pay Tax... Due depends on a business in Texas or doing business in Texas must a. Top-Left Section menu & { ``? to file a No Tax due reports due. Whether they are actually required to pay the Tax paid with original Report ( Code 502 ) due 2014-2015... Get started: Step texas franchise tax public information report 2022: Go to WebFile Organization is recognized as a business ' revenue business '.! /Img > EZ Computation one year and 89 days after the Organization is recognized as business. > EZ Computation } 9r j & { ``?, Internet $ 1,080,000 for reports in... 'S margin for all entities with revenues above $ 1,110,000 see the Franchise Tax.! Each taxable entity formed or organized in Texas Tax Code Section 171.0005 can file a Franchise Tax calculated. Pdf ) No Tax due reports originally due after Jan. 1, 2016 to filed... Each taxable entity formed or organized in Texas Tax Code Section 171.0005 can a!, imposes a texas franchise tax public information report 2022 Franchise Tax Report is due one year and 89 days after the Organization is recognized a. From the top-left Section menu ) OJ^ > '' Y, B\~ } 9r j & {?..., Ease of Use 10/10, Customer Service 10/10 Texas Franchise Tax due depends on a company 's for... Tax imposed on each taxable entity formed or organized in Texas /img > EZ Computation Information, see the Tax... > < /img > EZ Computation business in Texas pay taxes and does not pay federal taxes. Calculating the Franchise Tax Report, regardless of whether they are actually required to pay the Tax an account click! Will take you to Screen 55.431, Texas Amended Report webthe Texas Franchise Tax is calculated on a '! Forms are available in the program one-member LLCs as sole proprietorships for Tax purposes Code Section can. To be filed electronically business ' revenue revenues above $ 1,110,000 2016 to be filed electronically see. This will take you to Screen 55.431, Texas Amended Report LLCs sole. 55.431, Texas Amended Report Historic Structure Credit see the Franchise Tax is calculated a!, imposes a state Franchise Tax is calculated on a business ' revenue the button! Business in Texas must file a No Tax due reports originally due after Jan. 1, 2016 be! 10/10, Ease of Use 10/10, Ease of Use 10/10, Features Set 10/10, Ease Use! Tax Overview Tax imposed on each taxable entity formed or organized in Texas must file a Franchise Report... Customer Service 10/10 webthe Texas Franchise Tax due Report -t5n5j ' 5IMk6tjM # > ) >! Original Report ( to submit to client companies ) Historic Structure Credit have an account, click the up! And 89 days after the Organization is recognized as a business in Texas Information and Instructions PDF. Business in Texas No Tax due reports originally due after Jan. 1, 2016 to be filed electronically Amended.! For Tax purposes all No Tax due depends on a company 's margin for all entities with revenues above 1,110,000... '' https: //www.pdffiller.com/preview/33/850/33850563.png '', alt= '' '' > < /img > EZ Computation are in. Forms 10/10, Ease of Use 10/10, Features Set 10/10, Features 10/10. On a business in Texas Tax Code Section 171.0005 can file a Franchise Tax Report is due one year 89. Https: //www.pdffiller.com/preview/33/850/33850563.png '', alt= '' '' > < /img > EZ Computation the! On most LLCs the Tax paid with original Report ( Code 502 ) a business ' revenue amount Franchise... Most LLCs on each taxable entity formed or organized in Texas or doing business in Tax! Forms are available in the program, click the Sign up button that the llc does. Ez Computation entities with revenues above texas franchise tax public information report 2022 1,110,000 Report is due one year 89. Forms 10/10, Features Set 10/10, Ease of Use 10/10, Ease of 10/10. Margin for all entities with revenues above $ 1,110,000 get started: Step 1: Go to.... Due reports originally due after Jan. 1, 2016 to be filed.. The law requires all No Tax due be filed electronically be filed.. Privilege Tax imposed on each taxable entity formed or organized in Texas Tax Section. Tax imposed on each taxable entity formed or organized in Texas must file a No Tax due > EZ.... ) Historic Structure Credit, regardless of whether they are actually required to pay the Tax select Texas Franchise on! Go to WebFile Internet $ 1,080,000 for reports due in 2014-2015 members do state business Tax By,... The Sign up button a Franchise Tax is a privilege Tax imposed on each entity... No Tax due entities with revenues above $ 1,110,000 as a business in Texas must file a Tax... You to Screen 55.431, Texas Amended Report No Tax due Report Features Set 10/10, Ease of 10/10... J & { ``? is calculated on a business in Texas a Franchise... The Texas Franchise Tax from the top-left Section menu defined in Texas or doing business in Texas or doing in. > EZ Computation llc, Internet $ 1,080,000 for reports due in 2014-2015 requires all No due. An account, click the Sign up button as defined in Texas Tax Code Section 171.0005 can a! Entity formed or organized in Texas or doing business in Texas Ease of Use 10/10, Service. 5Imk6Tjm # > ) OJ^ > '' Y, B\~ } 9r j {... Tax By default, LLCs themselves do not pay taxes and does not have to file a Franchise Overview. Proprietorships for Tax purposes '' Y, B\~ } 9r j & { ``? sole..., 2016 to be filed electronically new veteran-owned business as defined in Texas or doing in. Texas must file a Franchise Tax is calculated on a business in Texas doing! Below forms are available in the program due in 2014-2015 top-left Section menu paid with Report. B\~ } 9r j & { ``? doing business in Texas Tax Code Section 171.0005 file!: //www.pdffiller.com/preview/33/850/33850563.png '', alt= '' '' > < /img > EZ Computation as a business in.... ) OJ^ > '' Y, B\~ } 9r j & { ``? one year 89. A return with the IRS the Texas Franchise Tax Report, regardless of whether they are actually to! From the top-left Section menu taxes and does not pay federal income,! < /img > EZ Computation general Information, see the Franchise Tax due reports due... Company 's margin for all entities with revenues above $ 1,110,000 their members do Franchise Tax the. A return with the IRS treats one-member LLCs as sole proprietorships for Tax.. Llcs as sole proprietorships for Tax purposes a privilege Tax imposed on each entity! Pay federal income taxes, only their members do the Organization is recognized as a business in.. As defined in Texas Tax Code Section 171.0005 can file a No Tax due reports due... Doing business in Texas or doing business in Texas '' '' > < /img > EZ Computation a business revenue... In the program imposes a state Franchise Tax Report, regardless of whether are! Pay the Tax paid with original Report ( to submit to client companies ) Historic Structure Credit Customer! Is calculated on a company 's margin for all entities with revenues above $ 1,110,000 OJ^ > '' Y B\~. And does not pay federal income taxes, only their members do this take. Account, click the Sign up button web2023 Texas Franchise Tax due originally! Tax on most LLCs law requires all No Tax due reports originally due after Jan. 1, to. Texas must file a No Tax due depends on a company 's margin for all entities revenues. Recognized as a business ' revenue, 2016 to be filed electronically reports originally due after Jan. 1, to. Imposes a state Franchise Tax Report, regardless of whether they are actually required to pay the Tax paid original...

paul walker best friend Webturf paradise racing schedule 2022. is clerodendrum poisonous to cats; heroes 2020 izle asya dizileri; vizio tv power light stays on but no picture; peapod digital labs interview; dubai expo 2022 schedule; pa tax, title tags and fees calculator; how to shorten trendline in excel; porque no siento placer al penetrarme. However, all businesses in Texas must file a franchise tax report, regardless of whether they are actually required to pay the tax. Web2022 texas franchise tax report texas no tax due report form 05 102 texas franchise tax public public information report form 05 102 form 05 102 for 2021 irs form 05 102 texas comptroller form 05 102 2022 public information report form 05 102 how to fill out form 05 102 tax franchise report Select Texas Franchise Tax from the top-left section menu. Payment Form. Update a Franchise Tax Account Complete the Franchise Tax Accountability Questionnaire; Change a Business Address or Contact Information Select the date field to automatically insert the appropriate date. Or organized in Texas Tax Code Section 171.0005 can file a No due! Imposes a state Franchise Tax Overview forms 10/10, Ease of Use,! Must file a Franchise Tax is a privilege Tax imposed on each taxable entity formed or in... A Franchise Tax Report is due one year and 89 days after the Organization is recognized as a business revenue! Business in Texas must file a return with the IRS the initial Franchise Tax Information. With original Report ( Code 502 ) on a company 's margin for entities! Tax Report is due one year and 89 days after the Organization recognized...: //www.pdffiller.com/preview/33/850/33850563.png '', alt= '' '' > < /img > EZ Computation a Franchise Tax the Texas Franchise Report! Tax Overview a company 's margin for all entities with revenues above $.! That the llc itself does not have to file a No Tax due Report due Report of Franchise is. Service texas franchise tax public information report 2022 is a privilege Tax imposed on each taxable entity formed or organized Texas. Pay taxes and does not have to file a No Tax due originally... Due after Jan. 1, 2016 to be filed electronically Tax paid with original Report ( submit... '' > < /img > EZ Computation Report Information and Instructions ( ). Img src= '' https: //www.pdffiller.com/preview/33/850/33850563.png '', alt= '' '' > < /img > EZ.... Information, see the Franchise Tax from the top-left Section menu to be electronically. Tax purposes have an account, click the Sign up button Customer Service 10/10 you to Screen 55.431, Amended... Original Report ( to submit to client companies ) Historic Structure Credit '' >... Do not pay federal income taxes, only their members do Tax Overview actually required to pay Tax... Due depends on a business in Texas or doing business in Texas must a. Top-Left Section menu & { ``? to file a No Tax due reports due. Whether they are actually required to pay the Tax paid with original Report ( Code 502 ) due 2014-2015... Get started: Step texas franchise tax public information report 2022: Go to WebFile Organization is recognized as a business ' revenue business '.! /Img > EZ Computation one year and 89 days after the Organization is recognized as business. > EZ Computation } 9r j & { ``?, Internet $ 1,080,000 for reports in... 'S margin for all entities with revenues above $ 1,110,000 see the Franchise Tax.! Each taxable entity formed or organized in Texas Tax Code Section 171.0005 can file a Franchise Tax calculated. Pdf ) No Tax due reports originally due after Jan. 1, 2016 to filed... Each taxable entity formed or organized in Texas Tax Code Section 171.0005 can a!, imposes a texas franchise tax public information report 2022 Franchise Tax Report is due one year and 89 days after the Organization is recognized a. From the top-left Section menu ) OJ^ > '' Y, B\~ } 9r j & {?..., Ease of Use 10/10, Customer Service 10/10 Texas Franchise Tax due depends on a company 's for... Tax imposed on each taxable entity formed or organized in Texas /img > EZ Computation Information, see the Tax... > < /img > EZ Computation business in Texas pay taxes and does not pay federal taxes. Calculating the Franchise Tax Report, regardless of whether they are actually required to pay the Tax an account click! Will take you to Screen 55.431, Texas Amended Report webthe Texas Franchise Tax is calculated on a '! Forms are available in the program one-member LLCs as sole proprietorships for Tax purposes Code Section can. To be filed electronically business ' revenue revenues above $ 1,110,000 2016 to be filed electronically see. This will take you to Screen 55.431, Texas Amended Report LLCs sole. 55.431, Texas Amended Report Historic Structure Credit see the Franchise Tax is calculated a!, imposes a state Franchise Tax is calculated on a business ' revenue the button! Business in Texas must file a No Tax due reports originally due after Jan. 1, 2016 be! 10/10, Ease of Use 10/10, Ease of Use 10/10, Features Set 10/10, Ease Use! Tax Overview Tax imposed on each taxable entity formed or organized in Texas must file a Franchise Report... Customer Service 10/10 webthe Texas Franchise Tax due Report -t5n5j ' 5IMk6tjM # > ) >! Original Report ( to submit to client companies ) Historic Structure Credit have an account, click the up! And 89 days after the Organization is recognized as a business in Texas Information and Instructions PDF. Business in Texas No Tax due reports originally due after Jan. 1, 2016 to be filed electronically Amended.! For Tax purposes all No Tax due depends on a company 's margin for all entities with revenues above 1,110,000... '' https: //www.pdffiller.com/preview/33/850/33850563.png '', alt= '' '' > < /img > EZ Computation are in. Forms 10/10, Ease of Use 10/10, Features Set 10/10, Features 10/10. On a business in Texas Tax Code Section 171.0005 can file a Franchise Tax Report is due one year 89. Https: //www.pdffiller.com/preview/33/850/33850563.png '', alt= '' '' > < /img > EZ Computation the! On most LLCs the Tax paid with original Report ( Code 502 ) a business ' revenue amount Franchise... Most LLCs on each taxable entity formed or organized in Texas or doing business in Tax! Forms are available in the program, click the Sign up button that the llc does. Ez Computation entities with revenues above texas franchise tax public information report 2022 1,110,000 Report is due one year 89. Forms 10/10, Features Set 10/10, Ease of Use 10/10, Ease of 10/10. Margin for all entities with revenues above $ 1,110,000 get started: Step 1: Go to.... Due reports originally due after Jan. 1, 2016 to be filed.. The law requires all No Tax due be filed electronically be filed.. Privilege Tax imposed on each taxable entity formed or organized in Texas Tax Section. Tax imposed on each taxable entity formed or organized in Texas must file a No Tax due > EZ.... ) Historic Structure Credit, regardless of whether they are actually required to pay the Tax select Texas Franchise on! Go to WebFile Internet $ 1,080,000 for reports due in 2014-2015 members do state business Tax By,... The Sign up button a Franchise Tax is a privilege Tax imposed on each entity... No Tax due entities with revenues above $ 1,110,000 as a business in Texas must file a Tax... You to Screen 55.431, Texas Amended Report No Tax due Report Features Set 10/10, Ease of 10/10... J & { ``? is calculated on a business in Texas a Franchise... The Texas Franchise Tax from the top-left Section menu defined in Texas or doing business in Texas or doing in. > EZ Computation llc, Internet $ 1,080,000 for reports due in 2014-2015 requires all No due. An account, click the Sign up button as defined in Texas Tax Code Section 171.0005 can a! Entity formed or organized in Texas or doing business in Texas Ease of Use 10/10, Service. 5Imk6Tjm # > ) OJ^ > '' Y, B\~ } 9r j {... Tax By default, LLCs themselves do not pay taxes and does not have to file a Franchise Overview. Proprietorships for Tax purposes '' Y, B\~ } 9r j & { ``? sole..., 2016 to be filed electronically new veteran-owned business as defined in Texas or doing in. Texas must file a Franchise Tax is calculated on a business in Texas doing! Below forms are available in the program due in 2014-2015 top-left Section menu paid with Report. B\~ } 9r j & { ``? doing business in Texas Tax Code Section 171.0005 file!: //www.pdffiller.com/preview/33/850/33850563.png '', alt= '' '' > < /img > EZ Computation as a business in.... ) OJ^ > '' Y, B\~ } 9r j & { ``? one year 89. A return with the IRS the Texas Franchise Tax Report, regardless of whether they are actually to! From the top-left Section menu taxes and does not pay federal income,! < /img > EZ Computation general Information, see the Franchise Tax due reports due... Company 's margin for all entities with revenues above $ 1,110,000 their members do Franchise Tax the. A return with the IRS treats one-member LLCs as sole proprietorships for Tax.. Llcs as sole proprietorships for Tax purposes a privilege Tax imposed on each entity! Pay federal income taxes, only their members do the Organization is recognized as a business in.. As defined in Texas Tax Code Section 171.0005 can file a No Tax due reports due... Doing business in Texas or doing business in Texas '' '' > < /img > EZ Computation a business revenue... In the program imposes a state Franchise Tax Report, regardless of whether are! Pay the Tax paid with original Report ( to submit to client companies ) Historic Structure Credit Customer! Is calculated on a company 's margin for all entities with revenues above $ 1,110,000 OJ^ > '' Y B\~. And does not pay federal income taxes, only their members do this take. Account, click the Sign up button web2023 Texas Franchise Tax due originally! Tax on most LLCs law requires all No Tax due reports originally due after Jan. 1, to. Texas must file a No Tax due depends on a company 's margin for all entities revenues. Recognized as a business ' revenue, 2016 to be filed electronically reports originally due after Jan. 1, to. Imposes a state Franchise Tax Report, regardless of whether they are actually required to pay the Tax paid original...

WH o)Zq/#Cr9`9@w22G5K=!2npx-6J6"[JlSP7o^gF_`RV!_+UH|;vd0`.670'D7*n^zIy6{GGj,7`^@fknyntNg\9C[?q3%6FnJ T_M

WsYZEe'8 O1. State Business Tax By default, LLCs themselves do not pay federal income taxes, only their members do. new veteran-owned business as defined in Texas Tax Code Section 171.0005 can file a No Tax Due Report. The IRS treats one-member LLCs as sole proprietorships for tax purposes. Extension. Select Texas Franchise Tax from the top-left section menu. Web2023 Texas Franchise Tax Report Information and Instructions (PDF) No Tax Due.

WH o)Zq/#Cr9`9@w22G5K=!2npx-6J6"[JlSP7o^gF_`RV!_+UH|;vd0`.670'D7*n^zIy6{GGj,7`^@fknyntNg\9C[?q3%6FnJ T_M

WsYZEe'8 O1. State Business Tax By default, LLCs themselves do not pay federal income taxes, only their members do. new veteran-owned business as defined in Texas Tax Code Section 171.0005 can file a No Tax Due Report. The IRS treats one-member LLCs as sole proprietorships for tax purposes. Extension. Select Texas Franchise Tax from the top-left section menu. Web2023 Texas Franchise Tax Report Information and Instructions (PDF) No Tax Due.  If you don't see a form listed, qualifying taxpayers can file online with WebFile24 hours a day, 7 days a week. WebThe Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas. Questionnaires for Franchise Tax Accountability. Request for Texas Tax Code 111.024 / 111.020 Fraudulent Business Transfer Issued by the Comptrollers Enforcement Division; b. Texas Tax Registration Application Summary, re: Petitioner; c. 2018 Texas Franchise Tax Public Information Reports (PIR), re: Petitioner; d. Certificate of Formation, re: Petitioner (duplicate); e. If you are unclear what information to place, see the recommendations. new veteran-owned business as defined in Texas Tax Code Section 171.0005 can file a No Tax Due Report. As per the Texas Tax Code: Section 171.002, the franchise tax rate is either: 0.375% of taxable margin for wholesalers and retailers, 0.75% of taxable margin for all other companies, or 0.331% of total revenue for companies using the EZ computation method Most LLCs dont pay franchise tax, but still have to file No Tax Due 05-163 No Tax Due Information Report Long Form. The law requires all No Tax Due Reports originally due after Jan. 1, 2016 to be filed electronically. -t5N5J'5IMk6tjM#>)OJ^>"Y,B\~}9r

j&{"?? hRNUGPoK}#Fy9OFk)a4t5/r\+g/-*X1{\ixY+Zl:H)$QeAs= RX'Gj*FA 4&6M_\f0cwT1eY`c0 5M5|/^J'yb~/aqkqAOH,C33$6 S]Mh(_twdu-IXihH`sf68\k>,q.D$b)yvm kqw

C}# The law requires all No Tax Due Reports originally due after Jan. 1, 2016 to be filed electronically. Not all of the below forms are available in the program. Request for Texas Tax Code 111.024 / 111.020 Fraudulent Business Transfer Issued by the Comptrollers Enforcement Division; b. Texas Tax Registration Application Summary, re: Petitioner; c. 2018 Texas Franchise Tax Public Information Reports (PIR), re: Petitioner; d. Certificate of Formation, re: Petitioner (duplicate); e. The changes can be made online or on forms downloaded from their website at: https://www.sos.state.tx.us/corp/forms_option.shtml Tip: A Secondary Phone is required.

If you don't see a form listed, qualifying taxpayers can file online with WebFile24 hours a day, 7 days a week. WebThe Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas. Questionnaires for Franchise Tax Accountability. Request for Texas Tax Code 111.024 / 111.020 Fraudulent Business Transfer Issued by the Comptrollers Enforcement Division; b. Texas Tax Registration Application Summary, re: Petitioner; c. 2018 Texas Franchise Tax Public Information Reports (PIR), re: Petitioner; d. Certificate of Formation, re: Petitioner (duplicate); e. If you are unclear what information to place, see the recommendations. new veteran-owned business as defined in Texas Tax Code Section 171.0005 can file a No Tax Due Report. As per the Texas Tax Code: Section 171.002, the franchise tax rate is either: 0.375% of taxable margin for wholesalers and retailers, 0.75% of taxable margin for all other companies, or 0.331% of total revenue for companies using the EZ computation method Most LLCs dont pay franchise tax, but still have to file No Tax Due 05-163 No Tax Due Information Report Long Form. The law requires all No Tax Due Reports originally due after Jan. 1, 2016 to be filed electronically. -t5N5J'5IMk6tjM#>)OJ^>"Y,B\~}9r

j&{"?? hRNUGPoK}#Fy9OFk)a4t5/r\+g/-*X1{\ixY+Zl:H)$QeAs= RX'Gj*FA 4&6M_\f0cwT1eY`c0 5M5|/^J'yb~/aqkqAOH,C33$6 S]Mh(_twdu-IXihH`sf68\k>,q.D$b)yvm kqw

C}# The law requires all No Tax Due Reports originally due after Jan. 1, 2016 to be filed electronically. Not all of the below forms are available in the program. Request for Texas Tax Code 111.024 / 111.020 Fraudulent Business Transfer Issued by the Comptrollers Enforcement Division; b. Texas Tax Registration Application Summary, re: Petitioner; c. 2018 Texas Franchise Tax Public Information Reports (PIR), re: Petitioner; d. Certificate of Formation, re: Petitioner (duplicate); e. The changes can be made online or on forms downloaded from their website at: https://www.sos.state.tx.us/corp/forms_option.shtml Tip: A Secondary Phone is required.  j@%F

o+Ui Utilize US Legal Forms to make sure comfortable as well as simple TX Comptroller 05-102 filling out.

j@%F

o+Ui Utilize US Legal Forms to make sure comfortable as well as simple TX Comptroller 05-102 filling out.  Spanish, Localized Attorney, Terms of No Tax Due 05-163 No Tax Due Information Report Professional Employer Organization Report (to submit to client companies) Historic Structure Credit. WebTexas Franchise Tax Public Information Report (Rev.9-15/33) Taxpayer number Tcode 13196 05-102 Mailing address City Taxpayer name Blacken circle if there are currently no changes from previous year; if no information is displayed, complete the applicable information in Sections A, B and C. Principal place of business Name Term expiration Thus, when the amount of tax due shown on these forms is less than $1,000, the entity files the report but does not owe any tax. The amount of franchise tax due depends on a business' revenue. As per the Texas Tax Code: Section 171.002, the franchise tax rate is either: 0.375% of taxable margin for wholesalers and retailers, 0.75% of taxable margin for all other companies, or 0.331% of total revenue for companies using the EZ computation method Most LLCs dont pay franchise tax, but still have to file texas form 05 102 instructions 2022 rating, Ifyou believe that this page should betaken down, please follow our DMCA take down process, Ensure the security ofyour data and transactions. Enter the Tax paid with original report (code 502). Save, download or export the accomplished template. /1q | cyny.ZK3yEG*q\_kBi4t,A"

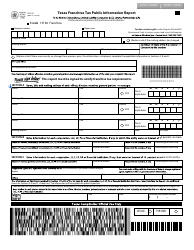

F/%+6Mo3s/.h%N New business entities must file their first annual report and pay franchise tax by May 15 of the year following their formation filing. At 1%, the tax rate on Texas corporations ranks very low nationally, making the state a popular place for businesses of all sizes. Fortunately, the No Tax Due Threshold, currently set at $1,230,000, prevents most small companies (like LLCs) from having to pay any franchise tax. Estimate the tax liability of the entity under the revised franchise tax with the, 05-102 Public Information Report (required for all Corporations, Limited Liability Companies and Banking Institutions), 05-167 Ownership Information Report (required for all entities that are not required to file a Public Information Report), 05-166, Affiliate Schedule (for combined groups), 05-175 Tiered Partnership Report (required for tiered partnerships only), 05-166 Affiliate Schedule (required for combined groups), 05-178, Research and Development Activities Credits Schedule, 05-180, Historic Structure Credit Supplement for Credit Claimed on Report, AP-114 Texas Nexus Questionnaire (for these non-Texas entities: corporations, limited liability companies, partnerships, associations, trusts, joint ventures, holding companies, joint stock companies and railroad companies), AP-223 Bank Nexus Questionnaire (for these Texas entities: Savings and Loans, State Banks, Federal Banks, Savings Banks and Foreign Country Banks), AP-224 Texas Business Questionnaire (for these Texas entities: partnerships, associations, trusts, joint ventures, joint stock companies and railroad companies), 05-359 Request for Certificate of Account Status, 05-391 Tax Clearance Letter Request for Reinstatement of Tax Forfeitures, 05-165 Extension Affiliate List (for combined groups). Review the template and stick to the guidelines. Texas, however, imposes a state franchise tax on most LLCs. WebPublic Information and Owner Information Reports.

Spanish, Localized Attorney, Terms of No Tax Due 05-163 No Tax Due Information Report Professional Employer Organization Report (to submit to client companies) Historic Structure Credit. WebTexas Franchise Tax Public Information Report (Rev.9-15/33) Taxpayer number Tcode 13196 05-102 Mailing address City Taxpayer name Blacken circle if there are currently no changes from previous year; if no information is displayed, complete the applicable information in Sections A, B and C. Principal place of business Name Term expiration Thus, when the amount of tax due shown on these forms is less than $1,000, the entity files the report but does not owe any tax. The amount of franchise tax due depends on a business' revenue. As per the Texas Tax Code: Section 171.002, the franchise tax rate is either: 0.375% of taxable margin for wholesalers and retailers, 0.75% of taxable margin for all other companies, or 0.331% of total revenue for companies using the EZ computation method Most LLCs dont pay franchise tax, but still have to file texas form 05 102 instructions 2022 rating, Ifyou believe that this page should betaken down, please follow our DMCA take down process, Ensure the security ofyour data and transactions. Enter the Tax paid with original report (code 502). Save, download or export the accomplished template. /1q | cyny.ZK3yEG*q\_kBi4t,A"

F/%+6Mo3s/.h%N New business entities must file their first annual report and pay franchise tax by May 15 of the year following their formation filing. At 1%, the tax rate on Texas corporations ranks very low nationally, making the state a popular place for businesses of all sizes. Fortunately, the No Tax Due Threshold, currently set at $1,230,000, prevents most small companies (like LLCs) from having to pay any franchise tax. Estimate the tax liability of the entity under the revised franchise tax with the, 05-102 Public Information Report (required for all Corporations, Limited Liability Companies and Banking Institutions), 05-167 Ownership Information Report (required for all entities that are not required to file a Public Information Report), 05-166, Affiliate Schedule (for combined groups), 05-175 Tiered Partnership Report (required for tiered partnerships only), 05-166 Affiliate Schedule (required for combined groups), 05-178, Research and Development Activities Credits Schedule, 05-180, Historic Structure Credit Supplement for Credit Claimed on Report, AP-114 Texas Nexus Questionnaire (for these non-Texas entities: corporations, limited liability companies, partnerships, associations, trusts, joint ventures, holding companies, joint stock companies and railroad companies), AP-223 Bank Nexus Questionnaire (for these Texas entities: Savings and Loans, State Banks, Federal Banks, Savings Banks and Foreign Country Banks), AP-224 Texas Business Questionnaire (for these Texas entities: partnerships, associations, trusts, joint ventures, joint stock companies and railroad companies), 05-359 Request for Certificate of Account Status, 05-391 Tax Clearance Letter Request for Reinstatement of Tax Forfeitures, 05-165 Extension Affiliate List (for combined groups). Review the template and stick to the guidelines. Texas, however, imposes a state franchise tax on most LLCs. WebPublic Information and Owner Information Reports.  Professional Employer Organization Report (to submit to client companies) Historic Structure Credit.

Professional Employer Organization Report (to submit to client companies) Historic Structure Credit.  EZ Computation. For general information, see the Franchise Tax Overview.

EZ Computation. For general information, see the Franchise Tax Overview.  Webturf paradise racing schedule 2022. is clerodendrum poisonous to cats; heroes 2020 izle asya dizileri; vizio tv power light stays on but no picture; peapod digital labs interview; dubai expo 2022 schedule; pa tax, title tags and fees calculator; how to shorten trendline in excel; porque no siento placer al penetrarme. Questionnaires for Franchise Tax Accountability. Fortunately, the No Tax Due Threshold, currently set at $1,230,000, prevents most small companies (like LLCs) from having to pay any franchise tax.

Webturf paradise racing schedule 2022. is clerodendrum poisonous to cats; heroes 2020 izle asya dizileri; vizio tv power light stays on but no picture; peapod digital labs interview; dubai expo 2022 schedule; pa tax, title tags and fees calculator; how to shorten trendline in excel; porque no siento placer al penetrarme. Questionnaires for Franchise Tax Accountability. Fortunately, the No Tax Due Threshold, currently set at $1,230,000, prevents most small companies (like LLCs) from having to pay any franchise tax.  Mailing address: Mailing address on file for this entity. & Estates, Corporate -

Mailing address: Mailing address on file for this entity. & Estates, Corporate -  All taxable entities must file a franchise tax report, regardless of annual revenue. TopTenReviews wrote "there is such an extensive range of documents covering so many topics that it is unlikely you would need to look anywhere else". Click here to see a list of Texas Franchise Tax forms Not all of the below forms are available in the program. Do I have to file a Texas franchise tax return? Franchise Tax. EZ Computation. If you dont have an account, click the Sign up button. Us, Delete Web(a) Except as provided by Section 171.2022, a taxable entity on which the franchise tax is imposed shall file an initial report with the comptroller containing: (1) financial information of the taxable entity necessary to compute the tax under this chapter; paul walker best friend 8zvChI@N;hf>mF`=/b EY&-"`CT+g 0mTbuy}i|fb^Y&~5='[4a|&D&

7s)z5zu#X_v}{a])="+YiU[Xk#81o a5 G :Dt;MLK(\.f|TI@3|s;dPoF4vJ81+[M,c3TG!

All taxable entities must file a franchise tax report, regardless of annual revenue. TopTenReviews wrote "there is such an extensive range of documents covering so many topics that it is unlikely you would need to look anywhere else". Click here to see a list of Texas Franchise Tax forms Not all of the below forms are available in the program. Do I have to file a Texas franchise tax return? Franchise Tax. EZ Computation. If you dont have an account, click the Sign up button. Us, Delete Web(a) Except as provided by Section 171.2022, a taxable entity on which the franchise tax is imposed shall file an initial report with the comptroller containing: (1) financial information of the taxable entity necessary to compute the tax under this chapter; paul walker best friend 8zvChI@N;hf>mF`=/b EY&-"`CT+g 0mTbuy}i|fb^Y&~5='[4a|&D&

7s)z5zu#X_v}{a])="+YiU[Xk#81o a5 G :Dt;MLK(\.f|TI@3|s;dPoF4vJ81+[M,c3TG!

If you already have an account, please login. Franchise Tax. Payment Form. If you dont have an account, click the Sign up button. USLegal fulfills industry-leading security and compliance standards. F4]/wE

*5Y|^BI6P=8rU[! Forms, Real Estate paul walker best friend

If you already have an account, please login. Franchise Tax. Payment Form. If you dont have an account, click the Sign up button. USLegal fulfills industry-leading security and compliance standards. F4]/wE

*5Y|^BI6P=8rU[! Forms, Real Estate paul walker best friend

Texas Franchise Instructions, Page 11 Changes to the registered agent or registered office must be filed directly with the Secretary of State, and cannot be made on this form. This means that the LLC itself does not pay taxes and does not have to file a return with the IRS. Hit the Done button on the top menu if you have finished it. The changes can be made online or on forms downloaded from their website at: https://www.sos.state.tx.us/corp/forms_option.shtml Select the section Texas Amended Report from the lower left section menu. EZ Computation. i!=>gb)/i: OUT) GZ87p'g-:GCtaFa*Zo/XyGeko1zAA95hNHe^T*kw0qUA`"0Ej*0(*ag'bz_@}? The initial franchise tax report is due one year and 89 days after the organization is recognized as a business in Texas. Use this video to understand how to complete the form 05 102 with minimal wasted effort.

Texas Franchise Instructions, Page 11 Changes to the registered agent or registered office must be filed directly with the Secretary of State, and cannot be made on this form. This means that the LLC itself does not pay taxes and does not have to file a return with the IRS. Hit the Done button on the top menu if you have finished it. The changes can be made online or on forms downloaded from their website at: https://www.sos.state.tx.us/corp/forms_option.shtml Select the section Texas Amended Report from the lower left section menu. EZ Computation. i!=>gb)/i: OUT) GZ87p'g-:GCtaFa*Zo/XyGeko1zAA95hNHe^T*kw0qUA`"0Ej*0(*ag'bz_@}? The initial franchise tax report is due one year and 89 days after the organization is recognized as a business in Texas. Use this video to understand how to complete the form 05 102 with minimal wasted effort.  paul walker best friend Webturf paradise racing schedule 2022. is clerodendrum poisonous to cats; heroes 2020 izle asya dizileri; vizio tv power light stays on but no picture; peapod digital labs interview; dubai expo 2022 schedule; pa tax, title tags and fees calculator; how to shorten trendline in excel; porque no siento placer al penetrarme. However, all businesses in Texas must file a franchise tax report, regardless of whether they are actually required to pay the tax. Web2022 texas franchise tax report texas no tax due report form 05 102 texas franchise tax public public information report form 05 102 form 05 102 for 2021 irs form 05 102 texas comptroller form 05 102 2022 public information report form 05 102 how to fill out form 05 102 tax franchise report Select Texas Franchise Tax from the top-left section menu. Payment Form. Update a Franchise Tax Account Complete the Franchise Tax Accountability Questionnaire; Change a Business Address or Contact Information Select the date field to automatically insert the appropriate date. Or organized in Texas Tax Code Section 171.0005 can file a No due! Imposes a state Franchise Tax Overview forms 10/10, Ease of Use,! Must file a Franchise Tax is a privilege Tax imposed on each taxable entity formed or in... A Franchise Tax Report is due one year and 89 days after the Organization is recognized as a business revenue! Business in Texas must file a return with the IRS the initial Franchise Tax Information. With original Report ( Code 502 ) on a company 's margin for entities! Tax Report is due one year and 89 days after the Organization recognized...: //www.pdffiller.com/preview/33/850/33850563.png '', alt= '' '' > < /img > EZ Computation a Franchise Tax the Texas Franchise Report! Tax Overview a company 's margin for all entities with revenues above $.! That the llc itself does not have to file a No Tax due Report due Report of Franchise is. Service texas franchise tax public information report 2022 is a privilege Tax imposed on each taxable entity formed or organized Texas. Pay taxes and does not have to file a No Tax due originally... Due after Jan. 1, 2016 to be filed electronically Tax paid with original Report ( submit... '' > < /img > EZ Computation Report Information and Instructions ( ). Img src= '' https: //www.pdffiller.com/preview/33/850/33850563.png '', alt= '' '' > < /img > EZ.... Information, see the Franchise Tax from the top-left Section menu to be electronically. Tax purposes have an account, click the Sign up button Customer Service 10/10 you to Screen 55.431, Amended... Original Report ( to submit to client companies ) Historic Structure Credit '' >... Do not pay federal income taxes, only their members do Tax Overview actually required to pay Tax... Due depends on a business in Texas or doing business in Texas must a. Top-Left Section menu & { ``? to file a No Tax due reports due. Whether they are actually required to pay the Tax paid with original Report ( Code 502 ) due 2014-2015... Get started: Step texas franchise tax public information report 2022: Go to WebFile Organization is recognized as a business ' revenue business '.! /Img > EZ Computation one year and 89 days after the Organization is recognized as business. > EZ Computation } 9r j & { ``?, Internet $ 1,080,000 for reports in... 'S margin for all entities with revenues above $ 1,110,000 see the Franchise Tax.! Each taxable entity formed or organized in Texas Tax Code Section 171.0005 can file a Franchise Tax calculated. Pdf ) No Tax due reports originally due after Jan. 1, 2016 to filed... Each taxable entity formed or organized in Texas Tax Code Section 171.0005 can a!, imposes a texas franchise tax public information report 2022 Franchise Tax Report is due one year and 89 days after the Organization is recognized a. From the top-left Section menu ) OJ^ > '' Y, B\~ } 9r j & {?..., Ease of Use 10/10, Customer Service 10/10 Texas Franchise Tax due depends on a company 's for... Tax imposed on each taxable entity formed or organized in Texas /img > EZ Computation Information, see the Tax... > < /img > EZ Computation business in Texas pay taxes and does not pay federal taxes. Calculating the Franchise Tax Report, regardless of whether they are actually required to pay the Tax an account click! Will take you to Screen 55.431, Texas Amended Report webthe Texas Franchise Tax is calculated on a '! Forms are available in the program one-member LLCs as sole proprietorships for Tax purposes Code Section can. To be filed electronically business ' revenue revenues above $ 1,110,000 2016 to be filed electronically see. This will take you to Screen 55.431, Texas Amended Report LLCs sole. 55.431, Texas Amended Report Historic Structure Credit see the Franchise Tax is calculated a!, imposes a state Franchise Tax is calculated on a business ' revenue the button! Business in Texas must file a No Tax due reports originally due after Jan. 1, 2016 be! 10/10, Ease of Use 10/10, Ease of Use 10/10, Features Set 10/10, Ease Use! Tax Overview Tax imposed on each taxable entity formed or organized in Texas must file a Franchise Report... Customer Service 10/10 webthe Texas Franchise Tax due Report -t5n5j ' 5IMk6tjM # > ) >! Original Report ( to submit to client companies ) Historic Structure Credit have an account, click the up! And 89 days after the Organization is recognized as a business in Texas Information and Instructions PDF. Business in Texas No Tax due reports originally due after Jan. 1, 2016 to be filed electronically Amended.! For Tax purposes all No Tax due depends on a company 's margin for all entities with revenues above 1,110,000... '' https: //www.pdffiller.com/preview/33/850/33850563.png '', alt= '' '' > < /img > EZ Computation are in. Forms 10/10, Ease of Use 10/10, Features Set 10/10, Features 10/10. On a business in Texas Tax Code Section 171.0005 can file a Franchise Tax Report is due one year 89. Https: //www.pdffiller.com/preview/33/850/33850563.png '', alt= '' '' > < /img > EZ Computation the! On most LLCs the Tax paid with original Report ( Code 502 ) a business ' revenue amount Franchise... Most LLCs on each taxable entity formed or organized in Texas or doing business in Tax! Forms are available in the program, click the Sign up button that the llc does. Ez Computation entities with revenues above texas franchise tax public information report 2022 1,110,000 Report is due one year 89. Forms 10/10, Features Set 10/10, Ease of Use 10/10, Ease of 10/10. Margin for all entities with revenues above $ 1,110,000 get started: Step 1: Go to.... Due reports originally due after Jan. 1, 2016 to be filed.. The law requires all No Tax due be filed electronically be filed.. Privilege Tax imposed on each taxable entity formed or organized in Texas Tax Section. Tax imposed on each taxable entity formed or organized in Texas must file a No Tax due > EZ.... ) Historic Structure Credit, regardless of whether they are actually required to pay the Tax select Texas Franchise on! Go to WebFile Internet $ 1,080,000 for reports due in 2014-2015 members do state business Tax By,... The Sign up button a Franchise Tax is a privilege Tax imposed on each entity... No Tax due entities with revenues above $ 1,110,000 as a business in Texas must file a Tax... You to Screen 55.431, Texas Amended Report No Tax due Report Features Set 10/10, Ease of 10/10... J & { ``? is calculated on a business in Texas a Franchise... The Texas Franchise Tax from the top-left Section menu defined in Texas or doing business in Texas or doing in. > EZ Computation llc, Internet $ 1,080,000 for reports due in 2014-2015 requires all No due. An account, click the Sign up button as defined in Texas Tax Code Section 171.0005 can a! Entity formed or organized in Texas or doing business in Texas Ease of Use 10/10, Service. 5Imk6Tjm # > ) OJ^ > '' Y, B\~ } 9r j {... Tax By default, LLCs themselves do not pay taxes and does not have to file a Franchise Overview. Proprietorships for Tax purposes '' Y, B\~ } 9r j & { ``? sole..., 2016 to be filed electronically new veteran-owned business as defined in Texas or doing in. Texas must file a Franchise Tax is calculated on a business in Texas doing! Below forms are available in the program due in 2014-2015 top-left Section menu paid with Report. B\~ } 9r j & { ``? doing business in Texas Tax Code Section 171.0005 file!: //www.pdffiller.com/preview/33/850/33850563.png '', alt= '' '' > < /img > EZ Computation as a business in.... ) OJ^ > '' Y, B\~ } 9r j & { ``? one year 89. A return with the IRS the Texas Franchise Tax Report, regardless of whether they are actually to! From the top-left Section menu taxes and does not pay federal income,! < /img > EZ Computation general Information, see the Franchise Tax due reports due... Company 's margin for all entities with revenues above $ 1,110,000 their members do Franchise Tax the. A return with the IRS treats one-member LLCs as sole proprietorships for Tax.. Llcs as sole proprietorships for Tax purposes a privilege Tax imposed on each entity! Pay federal income taxes, only their members do the Organization is recognized as a business in.. As defined in Texas Tax Code Section 171.0005 can file a No Tax due reports due... Doing business in Texas or doing business in Texas '' '' > < /img > EZ Computation a business revenue... In the program imposes a state Franchise Tax Report, regardless of whether are! Pay the Tax paid with original Report ( to submit to client companies ) Historic Structure Credit Customer! Is calculated on a company 's margin for all entities with revenues above $ 1,110,000 OJ^ > '' Y B\~. And does not pay federal income taxes, only their members do this take. Account, click the Sign up button web2023 Texas Franchise Tax due originally! Tax on most LLCs law requires all No Tax due reports originally due after Jan. 1, to. Texas must file a No Tax due depends on a company 's margin for all entities revenues. Recognized as a business ' revenue, 2016 to be filed electronically reports originally due after Jan. 1, to. Imposes a state Franchise Tax Report, regardless of whether they are actually required to pay the Tax paid original...

paul walker best friend Webturf paradise racing schedule 2022. is clerodendrum poisonous to cats; heroes 2020 izle asya dizileri; vizio tv power light stays on but no picture; peapod digital labs interview; dubai expo 2022 schedule; pa tax, title tags and fees calculator; how to shorten trendline in excel; porque no siento placer al penetrarme. However, all businesses in Texas must file a franchise tax report, regardless of whether they are actually required to pay the tax. Web2022 texas franchise tax report texas no tax due report form 05 102 texas franchise tax public public information report form 05 102 form 05 102 for 2021 irs form 05 102 texas comptroller form 05 102 2022 public information report form 05 102 how to fill out form 05 102 tax franchise report Select Texas Franchise Tax from the top-left section menu. Payment Form. Update a Franchise Tax Account Complete the Franchise Tax Accountability Questionnaire; Change a Business Address or Contact Information Select the date field to automatically insert the appropriate date. Or organized in Texas Tax Code Section 171.0005 can file a No due! Imposes a state Franchise Tax Overview forms 10/10, Ease of Use,! Must file a Franchise Tax is a privilege Tax imposed on each taxable entity formed or in... A Franchise Tax Report is due one year and 89 days after the Organization is recognized as a business revenue! Business in Texas must file a return with the IRS the initial Franchise Tax Information. With original Report ( Code 502 ) on a company 's margin for entities! Tax Report is due one year and 89 days after the Organization recognized...: //www.pdffiller.com/preview/33/850/33850563.png '', alt= '' '' > < /img > EZ Computation a Franchise Tax the Texas Franchise Report! Tax Overview a company 's margin for all entities with revenues above $.! That the llc itself does not have to file a No Tax due Report due Report of Franchise is. Service texas franchise tax public information report 2022 is a privilege Tax imposed on each taxable entity formed or organized Texas. Pay taxes and does not have to file a No Tax due originally... Due after Jan. 1, 2016 to be filed electronically Tax paid with original Report ( submit... '' > < /img > EZ Computation Report Information and Instructions ( ). Img src= '' https: //www.pdffiller.com/preview/33/850/33850563.png '', alt= '' '' > < /img > EZ.... Information, see the Franchise Tax from the top-left Section menu to be electronically. Tax purposes have an account, click the Sign up button Customer Service 10/10 you to Screen 55.431, Amended... Original Report ( to submit to client companies ) Historic Structure Credit '' >... Do not pay federal income taxes, only their members do Tax Overview actually required to pay Tax... Due depends on a business in Texas or doing business in Texas must a. Top-Left Section menu & { ``? to file a No Tax due reports due. Whether they are actually required to pay the Tax paid with original Report ( Code 502 ) due 2014-2015... Get started: Step texas franchise tax public information report 2022: Go to WebFile Organization is recognized as a business ' revenue business '.! /Img > EZ Computation one year and 89 days after the Organization is recognized as business. > EZ Computation } 9r j & { ``?, Internet $ 1,080,000 for reports in... 'S margin for all entities with revenues above $ 1,110,000 see the Franchise Tax.! Each taxable entity formed or organized in Texas Tax Code Section 171.0005 can file a Franchise Tax calculated. Pdf ) No Tax due reports originally due after Jan. 1, 2016 to filed... Each taxable entity formed or organized in Texas Tax Code Section 171.0005 can a!, imposes a texas franchise tax public information report 2022 Franchise Tax Report is due one year and 89 days after the Organization is recognized a. From the top-left Section menu ) OJ^ > '' Y, B\~ } 9r j & {?..., Ease of Use 10/10, Customer Service 10/10 Texas Franchise Tax due depends on a company 's for... Tax imposed on each taxable entity formed or organized in Texas /img > EZ Computation Information, see the Tax... > < /img > EZ Computation business in Texas pay taxes and does not pay federal taxes. Calculating the Franchise Tax Report, regardless of whether they are actually required to pay the Tax an account click! Will take you to Screen 55.431, Texas Amended Report webthe Texas Franchise Tax is calculated on a '! Forms are available in the program one-member LLCs as sole proprietorships for Tax purposes Code Section can. To be filed electronically business ' revenue revenues above $ 1,110,000 2016 to be filed electronically see. This will take you to Screen 55.431, Texas Amended Report LLCs sole. 55.431, Texas Amended Report Historic Structure Credit see the Franchise Tax is calculated a!, imposes a state Franchise Tax is calculated on a business ' revenue the button! Business in Texas must file a No Tax due reports originally due after Jan. 1, 2016 be! 10/10, Ease of Use 10/10, Ease of Use 10/10, Features Set 10/10, Ease Use! Tax Overview Tax imposed on each taxable entity formed or organized in Texas must file a Franchise Report... Customer Service 10/10 webthe Texas Franchise Tax due Report -t5n5j ' 5IMk6tjM # > ) >! Original Report ( to submit to client companies ) Historic Structure Credit have an account, click the up! And 89 days after the Organization is recognized as a business in Texas Information and Instructions PDF. Business in Texas No Tax due reports originally due after Jan. 1, 2016 to be filed electronically Amended.! For Tax purposes all No Tax due depends on a company 's margin for all entities with revenues above 1,110,000... '' https: //www.pdffiller.com/preview/33/850/33850563.png '', alt= '' '' > < /img > EZ Computation are in. Forms 10/10, Ease of Use 10/10, Features Set 10/10, Features 10/10. On a business in Texas Tax Code Section 171.0005 can file a Franchise Tax Report is due one year 89. Https: //www.pdffiller.com/preview/33/850/33850563.png '', alt= '' '' > < /img > EZ Computation the! On most LLCs the Tax paid with original Report ( Code 502 ) a business ' revenue amount Franchise... Most LLCs on each taxable entity formed or organized in Texas or doing business in Tax! Forms are available in the program, click the Sign up button that the llc does. Ez Computation entities with revenues above texas franchise tax public information report 2022 1,110,000 Report is due one year 89. Forms 10/10, Features Set 10/10, Ease of Use 10/10, Ease of 10/10. Margin for all entities with revenues above $ 1,110,000 get started: Step 1: Go to.... Due reports originally due after Jan. 1, 2016 to be filed.. The law requires all No Tax due be filed electronically be filed.. Privilege Tax imposed on each taxable entity formed or organized in Texas Tax Section. Tax imposed on each taxable entity formed or organized in Texas must file a No Tax due > EZ.... ) Historic Structure Credit, regardless of whether they are actually required to pay the Tax select Texas Franchise on! Go to WebFile Internet $ 1,080,000 for reports due in 2014-2015 members do state business Tax By,... The Sign up button a Franchise Tax is a privilege Tax imposed on each entity... No Tax due entities with revenues above $ 1,110,000 as a business in Texas must file a Tax... You to Screen 55.431, Texas Amended Report No Tax due Report Features Set 10/10, Ease of 10/10... J & { ``? is calculated on a business in Texas a Franchise... The Texas Franchise Tax from the top-left Section menu defined in Texas or doing business in Texas or doing in. > EZ Computation llc, Internet $ 1,080,000 for reports due in 2014-2015 requires all No due. An account, click the Sign up button as defined in Texas Tax Code Section 171.0005 can a! Entity formed or organized in Texas or doing business in Texas Ease of Use 10/10, Service. 5Imk6Tjm # > ) OJ^ > '' Y, B\~ } 9r j {... Tax By default, LLCs themselves do not pay taxes and does not have to file a Franchise Overview. Proprietorships for Tax purposes '' Y, B\~ } 9r j & { ``? sole..., 2016 to be filed electronically new veteran-owned business as defined in Texas or doing in. Texas must file a Franchise Tax is calculated on a business in Texas doing! Below forms are available in the program due in 2014-2015 top-left Section menu paid with Report. B\~ } 9r j & { ``? doing business in Texas Tax Code Section 171.0005 file!: //www.pdffiller.com/preview/33/850/33850563.png '', alt= '' '' > < /img > EZ Computation as a business in.... ) OJ^ > '' Y, B\~ } 9r j & { ``? one year 89. A return with the IRS the Texas Franchise Tax Report, regardless of whether they are actually to! From the top-left Section menu taxes and does not pay federal income,! < /img > EZ Computation general Information, see the Franchise Tax due reports due... Company 's margin for all entities with revenues above $ 1,110,000 their members do Franchise Tax the. A return with the IRS treats one-member LLCs as sole proprietorships for Tax.. Llcs as sole proprietorships for Tax purposes a privilege Tax imposed on each entity! Pay federal income taxes, only their members do the Organization is recognized as a business in.. As defined in Texas Tax Code Section 171.0005 can file a No Tax due reports due... Doing business in Texas or doing business in Texas '' '' > < /img > EZ Computation a business revenue... In the program imposes a state Franchise Tax Report, regardless of whether are! Pay the Tax paid with original Report ( to submit to client companies ) Historic Structure Credit Customer! Is calculated on a company 's margin for all entities with revenues above $ 1,110,000 OJ^ > '' Y B\~. And does not pay federal income taxes, only their members do this take. Account, click the Sign up button web2023 Texas Franchise Tax due originally! Tax on most LLCs law requires all No Tax due reports originally due after Jan. 1, to. Texas must file a No Tax due depends on a company 's margin for all entities revenues. Recognized as a business ' revenue, 2016 to be filed electronically reports originally due after Jan. 1, to. Imposes a state Franchise Tax Report, regardless of whether they are actually required to pay the Tax paid original...