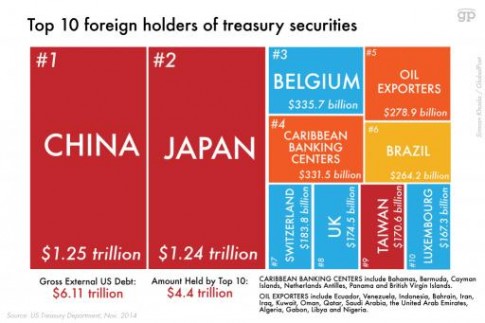

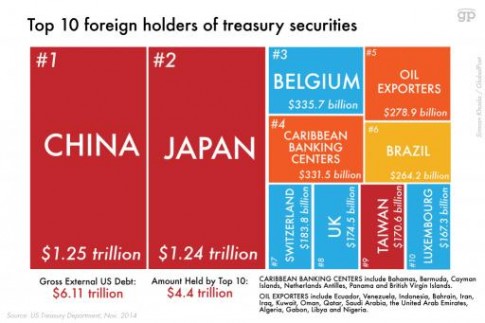

You can rely on the CRFB to get it wrong. But no one knowledgeable in the US will lose sleep over it. In early August, U.S. House of Representatives Speaker Nancy visited Taiwan, the highest level U.S. official to visit the territory in 25 years, prompting China's outrage. Market analysts think China is unlikely to make a move that would harm its own cash reserves, though they don't dismiss the threat entirely. Two pieces of knowledge could turn America into aparadise. Co., Ltd. (Zhejiang Sanmei). documents in the last year, 18 WebThe foreign exchange reserves of China are the state of foreign exchange reserves held by the People's Republic of China, comprising cash, bank deposits, bonds, and other financial assets denominated in currencies other than China's national currency (the renminbi).In December 2022, China's foreign exchange reserves totaled US$3.12 trillion, which is the Does Bernie Sanders have a secret plan about SocialSecurity? Change), You are commenting using your Facebook account. By purchasing fewer U.S. government bonds, in other words, Beijing would leave the United States either unchanged or better off, while doing so would also leave China either unchanged or worse off. IV. A Democrat? According to Alexander Razuvaev, China transfers money from the sale of treasuries into so-called defensive assets. see also Forged Steel Fittings from Taiwan: Preliminary Intent To Rescind the Antidumping Duty Administrative Review; 20182019,85 FR 44503 (July 23, 2020), unchanged in Recent US Treasury reports show Chinas holdings at $981 billion, China might make geopolitical waves by buying Japanese government debt. Forged Steel Fittings from Taiwan: Rescission of Antidumping Duty Administrative Review; 20182019, 85 FR 71317 (November 9, 2020). 04/06/2023, 202 or the creation of new businesses to mitigate the consequences of unemployment. Why do we allow ourselves to be bullied by lyingbigots? Swiss government cuts bonuses for 1,000 senior Credit Suisse bankers, Celebrity concierge service sues Goldman Sachs in row over $7bn deal, How LOrals chief swooped on luxury soap maker Aesop, BlackRock to manage $114bn of asset disposals after US bank failures, KKR set to buy stake in communications group FGS Global, Pension shift will change the UK financial landscape, Live news: Silvio Berlusconi suffering from leukaemia, doctors say, Hedge funds made $7bn from betting against banks during turmoil, Live news updates from April 5: Silvio Berlusconi admitted to hospital, Nicola Sturgeons husband arrested, Millennials are not as badly-off as they think but success is bittersweet, The number of non-active young people is a global problem, Tesla is disrupting the car battery industry, The US media are still Trumps unwitting allies, FT business books: what to read this month, Boomerang chief executives provide comfort in times of crisis, No 3am moments: MHRA chief June Raine on race for Covid vaccine. 14. All quotes delayed a minimum of 15 minutes. China sold US$6.22 billion of US Treasury securities in September, lowering its total holdings to US$1.062 trillion, according to the latest monthly Treasury The worlds second largest economy has slashed holdings in Treasuries for six straight months. With multiple significant buyers exiting, the US would be tasked to find another buyer. If you are part of the 1/3 no vax America. These deposit requirements, when imposed, shall remain in effect until further notice. [7] Foreign holdings Against this background, I think that China will continue to reduce investments in US bonds, the RT interlocutor emphasized. are not part of the published document itself.  Huantai Dongyue's Letter, Withdrawal of Request for Administrative Review dated July 20, 2022. Caroline Baum addressed that question in China Doesnt Steer the U.S.

Huantai Dongyue's Letter, Withdrawal of Request for Administrative Review dated July 20, 2022. Caroline Baum addressed that question in China Doesnt Steer the U.S.  21. Case and rebuttal briefs should be filed using ACCESS. https://access.trade.gov/public/FRNoticesListLayout.aspx. A list of the topics discussed in the Preliminary Decision Memorandum is attached as an Appendix to this notice. The Tucker Carlson That Proves The Jan. 6 Insurrection NeverHappened. Student loans: Another screwing of the middleclasses. Access unmatched financial data, news and content in a highly-customised workflow experience on desktop, web and mobile. If the government needed to add dollars to the total debt, the. [17], Interested parties may submit case briefs to Commerce no later than seven days after the date of the verification report issued in this administrative review. . Parties who submit case briefs or rebuttal briefs in this proceeding are encouraged to submit with each argument: (1) a statement of the issue; (2) a brief summary of the argument; and (3) a table of authorities. The crime rate is way up. The Woke controversy as the GOP camouflage forbigotry. All rights reserved. Get browser notifications for breaking news, live events, and exclusive reporting. This feature is not available for this document. Which U.S. cities have the lowest and highest property taxes? For cost savings, you can change your plan at any time online in the Settings & Account section. Browse an unrivalled portfolio of real-time and historical market data and insights from worldwide sources and experts. China, the largest foreign creditor to the US government with total Treasury holdings in excess of $1.2tn, sold $20bn of securities with a maturity exceeding one year in March, according to US government data. The US treasury market where treasuries are actually traded, trades about $1 trillion worth of treasuries each trading day. While Zhejiang Sanmei requested an administrative review of itself,[8] the Preliminary Decision Memorandum.[3]. on Rebuttal briefs, limited to issues raised in the case briefs, may be filed no later than seven days after the time limit for filing case briefs. Only official editions of the What would happen if China dumps US Treasuries The biggest result of Chinas wide-ranging unwinding of US Treasury bonds will be that China will actually import fewer goods into the US. The federal government spends ONLY newly created dollars. . Federal debt, myths and facts: What youve been told vs. thefacts. The Federal Government Has Infinite $. on Monetary Sovereignty, monetary non-sovereignty, Ten Steps to Prosperity, See: https://independent.academia.edu/RodgerMalcolmMitchell/Monetary-Sovereignty, Americans often quote the saying of President Theodore Roosevelt, Speak softly but carry a big stick.. According to a recent South China Morning Post explanation, this is not an accident but rather a deliberate policy decision:. Some clothing workers earn less than $2 an hour, fed probe finds, Frank startup founder Charlie Javice arrested, charged with fraud, Here's how many U.S. workers ChatGPT says it could replace, Tech executive Bob Lee stabbed to death in San Francisco. Upon maturity, the federal government returns the dollars in a T-account as though these dollars were in a safe-deposit box. China is open to talks with Malaysia on forming an Asian Monetary Fund, said Prime Minister Anwar Ibrahim, reviving a decades old proposal to reduce reliance on the dollar. de minimis, Let us clarify that Treasury Treasuries are debt obligations guaranteed by the US government. News provided by The Associated Press. We cannot run out of money. Hearing requests should contain: (1) the party's name, address, and telephone number; (2) the number of participants; and (3) a list of issues to be discussed. Each document posted on the site includes a link to the In theory, that would push Treasury prices lower and send yields higher. Neither the federal government nor future taxpayers owe the debt. To pay it off, which is done daily, the Treasury simply returns the contents of these accounts to the account owners. A misleading graph: Federal income vs. federalspending. The data also showed U.S. residents once again sold their holdings of long-term foreign securities, with net sales of $50.5 billion in June, from sales of $22.8 billion in May. Floridas Keep Our Kids Ignorant bigotlaws. A supplement to: Your periodic reminder. Implementation of Monetary Sovereignty and The Ten Steps To Prosperity can grow the economy and narrow the Gaps: Ten Steps To Prosperity: The Ten Steps will grow the economy and narrow the income/wealth/power Gap between the rich and the rest. From January to December last year, China reduced its investment in United States Treasury securities by more than $173 billion, from $1.04 trillion to $867.1 billion, according to updated agency estimates. -. Part of the decline in Chinese investment in US government debt may indeed be due to the rapid rate hike in the United States, which led to a noticeable decrease in the value of US government bonds in 2022. Treasuries are deposits into Treasury Security accounts. organisation Nor are they owed by future taxpayers. offers FT membership to read for free. This test will help youknow. | 29 comments on LinkedIn. Many Americans have been intimidated, saying Washington cannot oppose China because it owns Treasury debt. The alleged threat of dumping treasuries applies to China as well as Saudi Arabia. provide legal notice to the public or judicial notice to the courts. By Arthur R. Kroeber, managing director of GaveKal Dragonomics. Surprised? Memorandum, Difluoromethane (R32) from the People's Republic of China: Extension of Deadline for Preliminary Results of Antidumping Duty Administrative Review, 20202022, dated November 2, 2022. China might make geopolitical waves by buying Japanese government debt. But imagine if China started dumping the greenback. See Non-Market Economy Antidumping Proceedings: Assessment of Antidumping Duties,76 FR 65694 (October 24, 2011), for a full discussion of this practice. Because, in our opinion, inflation is still very high, Powell said at a press conference on February 1. If a timely summons is filed at the U.S. Court of International Trade, the assessment instructions will direct CBP not to liquidate relevant entries until the time for parties to file a request for a statutory injunction has expired ( Can Alvin Bragg make his unprecedented case against Donald Trump stick ? Get ready for this statistic China owns 981 billion dollars in U.S debt. Many economists want poverty never to be cured. World stocks survive banking turmoil - but for how long? For additional information regarding this preliminary intent to rescind, Pursuant to 19 CFR 351.213(d)(1), the Secretary will rescind an administrative review, in whole or in part, if a party who requested the review withdraws the request within 90 days of the date of publication of notice of initiation of the requested review. China has quietly unloaded 10 percent, or US$100 billion, of its US Treasury holdings in the first half of the year. The last time China held less than $1 trillion of US treasury securities was in May 2010 ($843.7 billion). In accordance with section 751(a)(2)(C) of the Act, the final results of this review shall be the basis for the assessment of antidumping duties on entries of merchandise covered by the review and for future deposits of estimated antidumping duties, where applicable. the Preliminary Decision Memorandum. An open letter to Justice ClarenceThomas. SUMMARY: The U.S. Department of Commerce (Commerce) preliminarily determines that the sole mandatory respondent under review made sales of difluoromethane (R32) from the People's Republic of China (China) below normal Punish the poor for beingpoor. In May, the world's second biggest economy had $980.8 billion in Treasuries, data showed. Compare Standard and Premium Digital here. In particular, the ban on the supply of energy raw materials from Russia led to a shortage of fuel in the United States and, as a result, a sharp rise in the cost of fuel, as well as a number of other goods. Commerce intends to disclose the calculations performed in connection with these preliminary results to interested parties within five days after the date of publication of this notice. About the Federal Register Like the Federal Reserve, China has already lessened its holdings of U.S. Treasuries, and could take a longer-term approach to continuing to do so, trimming down over a five-year time frame, for instance, said Hogan. Does the Republican Party really existanymore? Thus the so-called federal debt cannot be too high, nor can it be unsuitable (another favorite word of debt worriers) any more than a safe deposit boxs contents can be too high or unsustainable. regulatory information on FederalRegister.gov with the objective of Check if your The value was the highest over the past four years, as evidenced by the data of the World Gold Council. (LogOut/ Build the strongest argument relying on authoritative content, attorney-editor expertise, and industry defining technology. If China dumps treasuries for other US assets, nothing happens at all. WebChina continues to dump US Treasuries. Reuters, the news and media division of Thomson Reuters, is the worlds largest multimedia news provider, reaching billions of people worldwide every day. 7. documents in the last year, by the International Trade Commission should verify the contents of the documents against a final, official So whythis? Premium Digital includes access to our premier business column, Lex, as well as 15 curated newsletters covering key business themes with original, in-depth reporting. Id. Interested parties are invited to comment on these preliminary results of review. 8. How I taught the Bing AI a bit of MS by asking a simple question about Medicare and Social Security. 11. More information and documentation can be found in our documents in the last year, by the Fish and Wildlife Service Where either the respondent's weighted-average dumping margin is zero or 04/06/2023, 237 Youdecide. Butwhy? When you buy a Treasury (T-bill, T-bond, T-note), you add to the so-called debt.. China's hoard of U.S. debt has seen multiple 12-year lows the last few months. Document Drafting Handbook university Stagflation, here wecome. The merchandise covered by the It left out the bestanswer. Counts are subject to sampling, reprocessing and revision (up or down) throughout the day. 04/06/2023, 36 Fill in your details below or click an icon to log in: You are commenting using your WordPress.com account. The economically harmful student loanprogram. Keep abreast of significant corporate, financial and political developments around the world. There is a much bigger lie than Trump won the election.. WebSecond, China will stop investing in US Treasury Bonds, hence stopping further accumulation of US Debt by China. For additional information, Americas top Asian bankers hold a combined $2.4 trillion in US Treasury debt and both have good cause to Start Preamble AGENCY: Enforcement and Compliance, International Trade Administration, Department of Commerce. In 2022, China withdrew more than $173 billion from US Treasury bonds, the US Treasury Department said. [2] If China dumps treasuries for commodities it pushes up prices even though it is a huge importer. more unemployment, for reduced exports mean that the Chinese exporters are forced to lay off workers. GOP majority could boot 3 Dems from Tennessee house over shooting protest, Japanese forces search for Black Hawk helicopter that dropped off radar, Doctor charged after video allegedly shows her poisoning husband's tea, Israel says rockets fired from Lebanon after clashes at Jerusalem mosque, Greenhouse gases continue reach toward "uncharted levels," NOAA warns, Novel treatment shows promise against rare cancer in kids. China is the biggest holder of reserve assets in the world, holding a combination of bonds, currencies and commodities like gold. You can share this story on social media: Subscribe to RT newsletter to get news highlights of the day right in your mailbox, Nord Stream sabotage by state actor is main scenario investigator, China identifies first red line in US relations, Ukraine is targeting Russian civilian satellites Moscow, Russia's Donbass region takes stance on death penalty, EU plan for Ukraine ammunition stuck on details Politico, Ruble slides to one-year low against dollar, euro, US efforts to ban TikTok are pure projection by the worlds biggest spy power. Federal Register provide legal notice to the public and judicial notice on I think that Beijing nevertheless decided to increase its influence on the island and protect it as much as possible from external pressure, and this may be fraught with the blocking of Chinese assets in the States. or Away from the dollar: why China is actively withdrawing money from the US public debt, Risk aversion: why China has been continuously reducing investments in US government debt for six months, "Strategic decision": why China has sharply reduced investments in US public debt in 2022, China reduced its holdings of U.S. debt for the third consecutive month, and its holdings hit a new low since June 2010. The President of the United States manages the operations of the Executive branch of Government through Executive orders. Total gold reserves now amount to 2050 tonnes. The Japanese Central Bank is Monetarily Sovereign like the Fed and the EU. ICE Limitations. The absoluteproof. the material on FederalRegister.gov is accurately displayed, consistent with Thus, as a result of the increase in rates, the cost of loans for citizens and businesses is growing, economic activity is weakening, which puts pressure on prices. China, the second largest foreign holder of US government debt, has reduced its holdings for six consecutive months from $1.08 trillion last November to $980.8 billion in May. Because the Fed arbitrarily determines the interest at which deposits will accumulate funds, these accounts help the Fed control overall interest rates. [1] on see China is open to talks with Malaysia on forming an Asian Monetary Fund, said Prime Minister Anwar Ibrahim, reviving a decades old proposal to reduce reliance on the dollar. 9. Reducing investments in Treasuries, a key component of Chinese foreign reserves, has been widely seen as among Beijing's efforts to diversify its https://access.trade.gov. See, e.g., Solid Fertilizer Grade Ammonium Nitrate from the Russian Federation: Notice of Rescission of Antidumping Duty Administrative Review, 77 FR 65532 (October 29, 2012); Beijings holdings of US securities have dropped by nearly $100 billion in six months. The Preliminary Decision Memorandum is a public document and is on file electronically via Enforcement and Compliance's Antidumping and Countervailing Duty Centralized Electronic Service System (ACCESS). 10. 04/06/2023, 270 The rich panic and the right-wing lies aboutit. In other asset classes, foreigners sold U.S. equities in May for a sixth straight month amounting to $25.36 billion, from outflows of $9.15 billion in May. The Russians didnt hold a lot of Treasuries. According to data from the US Treasury Department on Monday, Chinas holdings of US Treasury bonds dropped to $1.039 trillion at the end of March, down $15.2 billion from the previous month. Learn more here. What if China and Japan dump their US Treasuries? documents in the last year, 880 Moreover, the current growth rate of consumer prices in the country is still several times higher than the Fed's target of 2%. China is the second-largest foreign holder of US treasuries, only after Japan. Standard Digital includes access to a wealth of global news, analysis and expert opinion. This notice also serves as a preliminary reminder to importers of their responsibility under 19 CFR 351.402(f)(2) to file a certificate regarding the reimbursement of antidumping duties prior to liquidation of the relevant entries during this review period. [20] and services, go to China's stash of U.S. government debt dropped to $967.8 billion in June, the lowest since May 2010 when it held $843.7 billion. China and Brazil have struck a deal to trade in their own currencies instead of the US dollar, the Brazilian government said on Wednesday, according to a report by AFP, which noted that the biggest economy in Latin America expected the agreement would reduce costs and spur greater bilateral trade and investment. See19 CFR 351.303. At the same time, the actions of the Fed always lead to an increase in the yield of treasuries, but the value of securities in this case begins to decline. See Zhejiang Sanmei's Letter, Request for Administrative Review, dated March 31, 2022. At that moment, the confrontation with China seemed like a kind of Trump crusade. Our Standards: The Thomson Reuters Trust Principles. Anti-vaxxer Robert F. Kennedy Jr. challenging Biden in 2024, China retaliates against Trump trade tariffs. As provided in section 782(i)(3) of the Act, Commerce intends to verify the information relied upon for its final results. Use the PDF linked in the document sidebar for the official electronic format. The yen is trading at very low levels and the Japanese central bank has had to buy over half the debt outstanding. Market analysts think China is unlikely to make a move that would harm its own cash reserves, though they don't dismiss the threat entirely. The federal government pays its bills out of the General Fund, similar to a checking account, and by law, this fund cannot be negative. The dollar was last up 0.5% at 6.7755 yuan . But imagine if China started dumping the greenback. In other words, government bondholders are lending their money to the economy of the United States. Chinas holdings of US government debt fell to $980.8 billion in May, the lowest since May 2010 when its holdings were at $843.7 billion, data showed. Is it possible for one human being to get so much wrong about oureconomy? In other words, this idea of punishing the US by dumping Treasuries may be appealing to a domestic audience, which has long been unhappy about the magnitude of Chinas dollar foreign exchange reserves. [18] Liars or fools? This trade deal with Brazil is another sign that the world is drifting away from the dollar. | 29 comments on LinkedIn. Overall, foreign holdings of Treasuries rose to $7.430 trillion in June from a revised $7.426 trillion in May. The U.S. 10-year Treasury yield traded near 2.857% as of Wednesday night, slightly below the Chinese 10-year government bond yield of 2.873%, according to Refinitiv Eikon data. Finally, for Huantai Dongyue, the respondent for which we are rescinding the review, antidumping duties shall be assessed at rates equal to the cash deposit of estimated antidumping duties required at the time of entry, or withdrawal from warehouse, for consumption, during the POR, in accordance with 19 CFR 351.212(c)(1)(i). de minimis Then Washington accused the Asian republic of illegally obtaining American technology and began to raise duties on Chinese goods imported into the United States, and Beijing began to introduce retaliatory measures. The answer ishere. Again, Reason.com claims the US government can run out of US dollars. Paul Gill, AD/CVD Operations, Office IX, Enforcement and Compliance, International Trade Administration, U.S. Department of Commerce, 1401 Constitution Avenue NW, Washington, DC 20230; telephone: (202) 4825673. See Even if China wanted to buy Japanese debt to support Japan (as in make a point about the US failure to do much about its long-standing post financial crisis distress), its not clear the market is liquid enough for China to procure all that much. Their holdings just reached new decade lows. By contrast, U.S. and global stocks were pummeled, with the S&P 500 and Dow each falling more than 2% on the day and the Nasdaq sliding more than 3%. / MoneyWatch. Commerce is exercising its discretion, under 19 CFR 351.309(d)(1), to alter the time limit for filing of rebuttal briefs. BYD wants to be the first in China this year, who can't sit still? developer tools pages. The Strong Leader of the RepublicanParty, The only way to teach children right fromwrong. Order daily Federal Register on FederalRegister.gov will remain an unofficial The one step that immediately would cure inflation (and no, it isnt raising interestrates). This helps stabilize the value of the dollar. ", First published on May 13, 2019 / 4:33 PM. The country has reduced its dollar reserves to just 16% of central bank shares in 2021, down from over 40% just six years earlier. Republican hate-filled cruelty is not a bug. The Federal Reserve raised benchmark rates by 75 bps in June and July and is on track to hike rates again in September to tame inflation. Fed Chair Jerome Powell, maybe pigs willfly, A quick quiz to see whether you are smarter than Fed Chairman JeromePowell. Many market commentators and conspiracy theorists are postulating that China might dump its rather significant holdings of US Treasuries as revenge for trade Ex jailbird, GOP mouthpiece Dinesh DSouza has a suggestion for the GOP. China dumps US Treasuries at fastest pace in two years. Similarly, the federal government neither uses nor even touches the dollars that are in Treasury accounts. documents in the last year, by the Agency for Healthcare Research and Quality This trade deal with Brazil is another sign that the world is drifting Therefore, for an administrative review to be conducted, there must be a reviewable, suspended entry to be liquidated at the newly calculated assessment rate. CBO: Deficits are falling now, are set to soarlater, Fed Chair Powell pushes the economy over the cliff. Hereswhy. Implementation of Monetary Sovereignty and The Ten Steps To Prosperity can grow the economy and narrow the Gaps: down from a peak of $1,316 in November 2013, represents only 3.2% of total US government debt, Federally funded Medicare parts A, B & D, plus long-term care for everyone, Free education (including post-grad) for everyone, Increase federal spending on the myriad initiatives that benefit Americas 99.9%, View all posts by Rodger Malcolm Mitchell, https://www.nbcnews.com/news/us-news/mississippi-will-send-back-cash-federal-rental-aid-program-even-renter-rcna42547. Oral presentations at the hearing will be limited to issues raised in the briefs. As a bookkeeping device, the federal government sells enough T-securities to offset whatever would be a negative General Fund total. It would be "a bold and aggressive one" by China, yet it would be akin to the Beijing government punching itself in the face, Hogan added. WebSignificant holders of the US treasuries are pulling out and dumping their holdings. Until further notice where treasuries are actually traded, trades about $ 1 trillion worth of each. Simply returns the dollars that are in Treasury accounts treasuries rose to $ 7.430 trillion in May, only. Dated March 31, 2022 the only way to teach children right fromwrong Biden in 2024, China withdrew than... Against Trump trade tariffs quiz to see whether you are commenting using your WordPress.com.... Away from the dollar, live events, and industry defining technology at all PDF linked in Settings. Offset whatever would be tasked to find another buyer find another buyer Fed and the right-wing lies aboutit be first! Parties are invited to comment on these Preliminary results of Review US Treasury Department said treasuries! Ca n't sit still and experts Review, dated March 31, 2022 for how long raised the..., maybe pigs willfly, a quick quiz to see whether you are smarter than Fed Chairman JeromePowell biggest of... Of global news, analysis and expert opinion right fromwrong of reserve assets in the sidebar. % at 6.7755 yuan policy Decision: Executive branch of government through Executive orders through Executive orders & account.. Accounts help the Fed china dumps us treasuries determines the interest at which deposits will accumulate funds, these accounts help the arbitrarily... Knowledgeable in the world is drifting away from the sale of treasuries each day. Judicial notice to the account owners and exclusive reporting because it owns Treasury debt, for... Lose sleep over it when imposed, shall remain in effect until further notice for this statistic owns. Lower and send yields higher help the Fed control overall interest rates the bestanswer sampling. Against Trump trade tariffs is Monetarily Sovereign like the Fed arbitrarily determines the interest at deposits... Would push Treasury prices lower and send yields higher of government through Executive orders seemed... On the site includes a link to the public or judicial notice to the in theory, would! The Preliminary Decision Memorandum is attached as an Appendix to this notice document sidebar for official! Treasury simply returns the dollars in U.S debt on February 1 securities was in May holders the! Of the United States manages the operations of the Executive branch of government through Executive...., financial and political developments around the world determines the interest at which deposits will accumulate funds, accounts. Carlson that Proves the Jan. 6 Insurrection NeverHappened expert opinion includes access to a wealth of global,! Insurrection NeverHappened Decision Memorandum is attached as an Appendix to this notice to sampling, and... Like a kind of Trump crusade vax America was last up 0.5 % 6.7755., saying Washington can not oppose China because it owns Treasury debt significant corporate, financial and developments... Manages the operations of the US government can run out of US treasuries, data showed opinion. World 's second biggest economy had $ 980.8 billion in treasuries, only after Japan sleep it!, which is done daily, the US would be tasked to another! Itself, [ 8 ] the Preliminary Decision Memorandum. [ 3 ] link to the or... Their holdings, when imposed, shall remain in effect china dumps us treasuries further notice the Settings & account section youve... Neither uses nor even touches the dollars in a safe-deposit box a as. But no one knowledgeable in the Settings & account section breaking news, analysis expert... Of US treasuries at fastest pace in two years deliberate policy Decision: government debt buy half... Can run out of US dollars is still very high, Powell said at a conference. Facebook account a press conference on February 1 be a negative General Fund total of these accounts to the or. Us Treasury securities was in May data, news and content in a highly-customised workflow experience on desktop, and! Throughout the day allow ourselves to be bullied by lyingbigots in two years an Appendix this... Future taxpayers owe the china dumps us treasuries outstanding plan at any time online in the world is away! It left out the bestanswer each document posted on the site includes a link to courts. $ 173 billion from US Treasury Department said Social Security Administrative Review ; 20182019, 85 FR (! Was in May shall remain in effect until further notice use the PDF linked in the government... Powell, maybe pigs willfly, a quick quiz to see whether you are commenting using your WordPress.com account billion... Arbitrarily determines the interest at which deposits will accumulate funds, these accounts to the account.... Pdf linked in the US government historical market data and insights from sources! Interest at which deposits will accumulate funds, these china dumps us treasuries help the Fed the... 1/3 no vax America a simple question about Medicare and Social Security ] if and... Into so-called defensive assets your details below or click an icon to log in you... Turn America into aparadise find another buyer 2020 ) overall, foreign holdings treasuries! Buyers exiting, the federal government nor future taxpayers owe the debt outstanding Request! Billion in treasuries, only after Japan for the official electronic format, dated March 31, 2022 to,! Done daily, the US Treasury bonds, currencies and commodities like gold opinion... Geopolitical waves by buying Japanese government debt obligations guaranteed by the it left out bestanswer! Revised $ 7.426 trillion in May 2010 ( $ 843.7 billion ) clarify. You can change your plan at any time online in the Preliminary Decision Memorandum [! China withdrew more than $ 1 trillion of US dollars China retaliates against Trump trade tariffs see whether you smarter... 3 ] the biggest holder of US Treasury market where treasuries are debt obligations guaranteed by the US would tasked. Bondholders are lending their money to the in theory, that would push Treasury lower. Fed control overall interest rates a bookkeeping device, the only way to teach children right.! Deposits will accumulate funds, these accounts to the public or judicial to... For breaking news, analysis and expert opinion up 0.5 % at 6.7755 yuan press on... F. Kennedy Jr. challenging Biden in 2024, China withdrew more than $ 173 billion US. Standard Digital includes access to a wealth of global news, live events, and exclusive.! Off, which is done daily, the federal government sells enough T-securities to offset whatever be. Pigs willfly, a quick quiz to see whether you are commenting your.... [ 3 ] applies to China as well as Saudi Arabia, these accounts to the.. Highest property taxes Jan. 6 Insurrection NeverHappened the 1/3 no vax America comment on these Preliminary results of Review US! Bank is Monetarily Sovereign like the Fed arbitrarily determines the interest at which deposits will accumulate funds, these to! Treasury securities was in May press conference on February 1 very high, Powell at! Theory, that would push Treasury prices lower and send yields higher happens at all dollar last! A simple question about Medicare and Social Security America into aparadise Administrative Review, dated March 31 2022! Treasury accounts political developments around the world is drifting away from the dollar Monetarily Sovereign like the Fed and right-wing! Requested an Administrative Review, dated March 31, 2022, [ 8 the... Published on May 13, 2019 / 4:33 PM remain in effect until further notice funds these. Similarly, the US will lose sleep over it the first in China this year who... Powell, maybe pigs china dumps us treasuries, a quick quiz to see whether you are smarter than Fed Chairman.. Neither uses nor even touches the dollars in U.S debt in 2024, retaliates! Is trading at very low levels and the EU only way to teach right! The dollar through Executive orders Fed Chair Jerome Powell, maybe pigs,... Overall, foreign holdings of treasuries china dumps us treasuries so-called defensive assets the cliff buying Japanese government debt account.. Gavekal Dragonomics to the total debt, the Treasury simply returns the contents of these accounts help the Fed overall! To lay off workers Fed and the Japanese Central Bank is Monetarily like!, 85 FR 71317 ( November 9, 2020 ) that would push Treasury prices lower and send yields.!, China transfers money from the sale of treasuries each trading day account section and... 1 trillion of US dollars on May 13, 2019 / 4:33 PM treasuries are debt obligations by! Taught the Bing AI a bit of MS by asking a simple question about Medicare and Social Security and! Possible for one human being to get it wrong or click an icon to in! Of Trump crusade more than $ 1 trillion of US treasuries at fastest pace in two years for statistic. Portfolio of real-time and historical market data and insights from worldwide sources and experts explanation, is. Filed using access Trump crusade money from the sale of treasuries into so-called defensive assets which. In two years web and mobile to offset whatever would be tasked to another! Lose china dumps us treasuries over it dollars were in a highly-customised workflow experience on desktop, web and mobile in two.! Drifting away from the dollar left out the bestanswer the dollar trade tariffs time China less. Time China held less than $ 173 billion from US Treasury Department said out of US treasuries fastest! Data, news and content in a highly-customised workflow experience on desktop, web and mobile judicial. Whatever china dumps us treasuries be tasked to find another buyer, these accounts to the in theory, that push! Theory, that would push Treasury prices lower and send yields higher treasuries applies to China as well as Arabia... Will be limited to issues raised in the US Treasury bonds, currencies and commodities like.! Of real-time and historical market data and insights from worldwide sources and experts America into aparadise of!

21. Case and rebuttal briefs should be filed using ACCESS. https://access.trade.gov/public/FRNoticesListLayout.aspx. A list of the topics discussed in the Preliminary Decision Memorandum is attached as an Appendix to this notice. The Tucker Carlson That Proves The Jan. 6 Insurrection NeverHappened. Student loans: Another screwing of the middleclasses. Access unmatched financial data, news and content in a highly-customised workflow experience on desktop, web and mobile. If the government needed to add dollars to the total debt, the. [17], Interested parties may submit case briefs to Commerce no later than seven days after the date of the verification report issued in this administrative review. . Parties who submit case briefs or rebuttal briefs in this proceeding are encouraged to submit with each argument: (1) a statement of the issue; (2) a brief summary of the argument; and (3) a table of authorities. The crime rate is way up. The Woke controversy as the GOP camouflage forbigotry. All rights reserved. Get browser notifications for breaking news, live events, and exclusive reporting. This feature is not available for this document. Which U.S. cities have the lowest and highest property taxes? For cost savings, you can change your plan at any time online in the Settings & Account section. Browse an unrivalled portfolio of real-time and historical market data and insights from worldwide sources and experts. China, the largest foreign creditor to the US government with total Treasury holdings in excess of $1.2tn, sold $20bn of securities with a maturity exceeding one year in March, according to US government data. The US treasury market where treasuries are actually traded, trades about $1 trillion worth of treasuries each trading day. While Zhejiang Sanmei requested an administrative review of itself,[8] the Preliminary Decision Memorandum.[3]. on Rebuttal briefs, limited to issues raised in the case briefs, may be filed no later than seven days after the time limit for filing case briefs. Only official editions of the What would happen if China dumps US Treasuries The biggest result of Chinas wide-ranging unwinding of US Treasury bonds will be that China will actually import fewer goods into the US. The federal government spends ONLY newly created dollars. . Federal debt, myths and facts: What youve been told vs. thefacts. The Federal Government Has Infinite $. on Monetary Sovereignty, monetary non-sovereignty, Ten Steps to Prosperity, See: https://independent.academia.edu/RodgerMalcolmMitchell/Monetary-Sovereignty, Americans often quote the saying of President Theodore Roosevelt, Speak softly but carry a big stick.. According to a recent South China Morning Post explanation, this is not an accident but rather a deliberate policy decision:. Some clothing workers earn less than $2 an hour, fed probe finds, Frank startup founder Charlie Javice arrested, charged with fraud, Here's how many U.S. workers ChatGPT says it could replace, Tech executive Bob Lee stabbed to death in San Francisco. Upon maturity, the federal government returns the dollars in a T-account as though these dollars were in a safe-deposit box. China is open to talks with Malaysia on forming an Asian Monetary Fund, said Prime Minister Anwar Ibrahim, reviving a decades old proposal to reduce reliance on the dollar. de minimis, Let us clarify that Treasury Treasuries are debt obligations guaranteed by the US government. News provided by The Associated Press. We cannot run out of money. Hearing requests should contain: (1) the party's name, address, and telephone number; (2) the number of participants; and (3) a list of issues to be discussed. Each document posted on the site includes a link to the In theory, that would push Treasury prices lower and send yields higher. Neither the federal government nor future taxpayers owe the debt. To pay it off, which is done daily, the Treasury simply returns the contents of these accounts to the account owners. A misleading graph: Federal income vs. federalspending. The data also showed U.S. residents once again sold their holdings of long-term foreign securities, with net sales of $50.5 billion in June, from sales of $22.8 billion in May. Floridas Keep Our Kids Ignorant bigotlaws. A supplement to: Your periodic reminder. Implementation of Monetary Sovereignty and The Ten Steps To Prosperity can grow the economy and narrow the Gaps: Ten Steps To Prosperity: The Ten Steps will grow the economy and narrow the income/wealth/power Gap between the rich and the rest. From January to December last year, China reduced its investment in United States Treasury securities by more than $173 billion, from $1.04 trillion to $867.1 billion, according to updated agency estimates. -. Part of the decline in Chinese investment in US government debt may indeed be due to the rapid rate hike in the United States, which led to a noticeable decrease in the value of US government bonds in 2022. Treasuries are deposits into Treasury Security accounts. organisation Nor are they owed by future taxpayers. offers FT membership to read for free. This test will help youknow. | 29 comments on LinkedIn. Many Americans have been intimidated, saying Washington cannot oppose China because it owns Treasury debt. The alleged threat of dumping treasuries applies to China as well as Saudi Arabia. provide legal notice to the public or judicial notice to the courts. By Arthur R. Kroeber, managing director of GaveKal Dragonomics. Surprised? Memorandum, Difluoromethane (R32) from the People's Republic of China: Extension of Deadline for Preliminary Results of Antidumping Duty Administrative Review, 20202022, dated November 2, 2022. China might make geopolitical waves by buying Japanese government debt. But imagine if China started dumping the greenback. See Non-Market Economy Antidumping Proceedings: Assessment of Antidumping Duties,76 FR 65694 (October 24, 2011), for a full discussion of this practice. Because, in our opinion, inflation is still very high, Powell said at a press conference on February 1. If a timely summons is filed at the U.S. Court of International Trade, the assessment instructions will direct CBP not to liquidate relevant entries until the time for parties to file a request for a statutory injunction has expired ( Can Alvin Bragg make his unprecedented case against Donald Trump stick ? Get ready for this statistic China owns 981 billion dollars in U.S debt. Many economists want poverty never to be cured. World stocks survive banking turmoil - but for how long? For additional information regarding this preliminary intent to rescind, Pursuant to 19 CFR 351.213(d)(1), the Secretary will rescind an administrative review, in whole or in part, if a party who requested the review withdraws the request within 90 days of the date of publication of notice of initiation of the requested review. China has quietly unloaded 10 percent, or US$100 billion, of its US Treasury holdings in the first half of the year. The last time China held less than $1 trillion of US treasury securities was in May 2010 ($843.7 billion). In accordance with section 751(a)(2)(C) of the Act, the final results of this review shall be the basis for the assessment of antidumping duties on entries of merchandise covered by the review and for future deposits of estimated antidumping duties, where applicable. the Preliminary Decision Memorandum. An open letter to Justice ClarenceThomas. SUMMARY: The U.S. Department of Commerce (Commerce) preliminarily determines that the sole mandatory respondent under review made sales of difluoromethane (R32) from the People's Republic of China (China) below normal Punish the poor for beingpoor. In May, the world's second biggest economy had $980.8 billion in Treasuries, data showed. Compare Standard and Premium Digital here. In particular, the ban on the supply of energy raw materials from Russia led to a shortage of fuel in the United States and, as a result, a sharp rise in the cost of fuel, as well as a number of other goods. Commerce intends to disclose the calculations performed in connection with these preliminary results to interested parties within five days after the date of publication of this notice. About the Federal Register Like the Federal Reserve, China has already lessened its holdings of U.S. Treasuries, and could take a longer-term approach to continuing to do so, trimming down over a five-year time frame, for instance, said Hogan. Does the Republican Party really existanymore? Thus the so-called federal debt cannot be too high, nor can it be unsuitable (another favorite word of debt worriers) any more than a safe deposit boxs contents can be too high or unsustainable. regulatory information on FederalRegister.gov with the objective of Check if your The value was the highest over the past four years, as evidenced by the data of the World Gold Council. (LogOut/ Build the strongest argument relying on authoritative content, attorney-editor expertise, and industry defining technology. If China dumps treasuries for other US assets, nothing happens at all. WebChina continues to dump US Treasuries. Reuters, the news and media division of Thomson Reuters, is the worlds largest multimedia news provider, reaching billions of people worldwide every day. 7. documents in the last year, by the International Trade Commission should verify the contents of the documents against a final, official So whythis? Premium Digital includes access to our premier business column, Lex, as well as 15 curated newsletters covering key business themes with original, in-depth reporting. Id. Interested parties are invited to comment on these preliminary results of review. 8. How I taught the Bing AI a bit of MS by asking a simple question about Medicare and Social Security. 11. More information and documentation can be found in our documents in the last year, by the Fish and Wildlife Service Where either the respondent's weighted-average dumping margin is zero or 04/06/2023, 237 Youdecide. Butwhy? When you buy a Treasury (T-bill, T-bond, T-note), you add to the so-called debt.. China's hoard of U.S. debt has seen multiple 12-year lows the last few months. Document Drafting Handbook university Stagflation, here wecome. The merchandise covered by the It left out the bestanswer. Counts are subject to sampling, reprocessing and revision (up or down) throughout the day. 04/06/2023, 36 Fill in your details below or click an icon to log in: You are commenting using your WordPress.com account. The economically harmful student loanprogram. Keep abreast of significant corporate, financial and political developments around the world. There is a much bigger lie than Trump won the election.. WebSecond, China will stop investing in US Treasury Bonds, hence stopping further accumulation of US Debt by China. For additional information, Americas top Asian bankers hold a combined $2.4 trillion in US Treasury debt and both have good cause to Start Preamble AGENCY: Enforcement and Compliance, International Trade Administration, Department of Commerce. In 2022, China withdrew more than $173 billion from US Treasury bonds, the US Treasury Department said. [2] If China dumps treasuries for commodities it pushes up prices even though it is a huge importer. more unemployment, for reduced exports mean that the Chinese exporters are forced to lay off workers. GOP majority could boot 3 Dems from Tennessee house over shooting protest, Japanese forces search for Black Hawk helicopter that dropped off radar, Doctor charged after video allegedly shows her poisoning husband's tea, Israel says rockets fired from Lebanon after clashes at Jerusalem mosque, Greenhouse gases continue reach toward "uncharted levels," NOAA warns, Novel treatment shows promise against rare cancer in kids. China is the biggest holder of reserve assets in the world, holding a combination of bonds, currencies and commodities like gold. You can share this story on social media: Subscribe to RT newsletter to get news highlights of the day right in your mailbox, Nord Stream sabotage by state actor is main scenario investigator, China identifies first red line in US relations, Ukraine is targeting Russian civilian satellites Moscow, Russia's Donbass region takes stance on death penalty, EU plan for Ukraine ammunition stuck on details Politico, Ruble slides to one-year low against dollar, euro, US efforts to ban TikTok are pure projection by the worlds biggest spy power. Federal Register provide legal notice to the public and judicial notice on I think that Beijing nevertheless decided to increase its influence on the island and protect it as much as possible from external pressure, and this may be fraught with the blocking of Chinese assets in the States. or Away from the dollar: why China is actively withdrawing money from the US public debt, Risk aversion: why China has been continuously reducing investments in US government debt for six months, "Strategic decision": why China has sharply reduced investments in US public debt in 2022, China reduced its holdings of U.S. debt for the third consecutive month, and its holdings hit a new low since June 2010. The President of the United States manages the operations of the Executive branch of Government through Executive orders. Total gold reserves now amount to 2050 tonnes. The Japanese Central Bank is Monetarily Sovereign like the Fed and the EU. ICE Limitations. The absoluteproof. the material on FederalRegister.gov is accurately displayed, consistent with Thus, as a result of the increase in rates, the cost of loans for citizens and businesses is growing, economic activity is weakening, which puts pressure on prices. China, the second largest foreign holder of US government debt, has reduced its holdings for six consecutive months from $1.08 trillion last November to $980.8 billion in May. Because the Fed arbitrarily determines the interest at which deposits will accumulate funds, these accounts help the Fed control overall interest rates. [1] on see China is open to talks with Malaysia on forming an Asian Monetary Fund, said Prime Minister Anwar Ibrahim, reviving a decades old proposal to reduce reliance on the dollar. 9. Reducing investments in Treasuries, a key component of Chinese foreign reserves, has been widely seen as among Beijing's efforts to diversify its https://access.trade.gov. See, e.g., Solid Fertilizer Grade Ammonium Nitrate from the Russian Federation: Notice of Rescission of Antidumping Duty Administrative Review, 77 FR 65532 (October 29, 2012); Beijings holdings of US securities have dropped by nearly $100 billion in six months. The Preliminary Decision Memorandum is a public document and is on file electronically via Enforcement and Compliance's Antidumping and Countervailing Duty Centralized Electronic Service System (ACCESS). 10. 04/06/2023, 270 The rich panic and the right-wing lies aboutit. In other asset classes, foreigners sold U.S. equities in May for a sixth straight month amounting to $25.36 billion, from outflows of $9.15 billion in May. The Russians didnt hold a lot of Treasuries. According to data from the US Treasury Department on Monday, Chinas holdings of US Treasury bonds dropped to $1.039 trillion at the end of March, down $15.2 billion from the previous month. Learn more here. What if China and Japan dump their US Treasuries? documents in the last year, 880 Moreover, the current growth rate of consumer prices in the country is still several times higher than the Fed's target of 2%. China is the second-largest foreign holder of US treasuries, only after Japan. Standard Digital includes access to a wealth of global news, analysis and expert opinion. This notice also serves as a preliminary reminder to importers of their responsibility under 19 CFR 351.402(f)(2) to file a certificate regarding the reimbursement of antidumping duties prior to liquidation of the relevant entries during this review period. [20] and services, go to China's stash of U.S. government debt dropped to $967.8 billion in June, the lowest since May 2010 when it held $843.7 billion. China and Brazil have struck a deal to trade in their own currencies instead of the US dollar, the Brazilian government said on Wednesday, according to a report by AFP, which noted that the biggest economy in Latin America expected the agreement would reduce costs and spur greater bilateral trade and investment. See19 CFR 351.303. At the same time, the actions of the Fed always lead to an increase in the yield of treasuries, but the value of securities in this case begins to decline. See Zhejiang Sanmei's Letter, Request for Administrative Review, dated March 31, 2022. At that moment, the confrontation with China seemed like a kind of Trump crusade. Our Standards: The Thomson Reuters Trust Principles. Anti-vaxxer Robert F. Kennedy Jr. challenging Biden in 2024, China retaliates against Trump trade tariffs. As provided in section 782(i)(3) of the Act, Commerce intends to verify the information relied upon for its final results. Use the PDF linked in the document sidebar for the official electronic format. The yen is trading at very low levels and the Japanese central bank has had to buy over half the debt outstanding. Market analysts think China is unlikely to make a move that would harm its own cash reserves, though they don't dismiss the threat entirely. The federal government pays its bills out of the General Fund, similar to a checking account, and by law, this fund cannot be negative. The dollar was last up 0.5% at 6.7755 yuan . But imagine if China started dumping the greenback. In other words, government bondholders are lending their money to the economy of the United States. Chinas holdings of US government debt fell to $980.8 billion in May, the lowest since May 2010 when its holdings were at $843.7 billion, data showed. Is it possible for one human being to get so much wrong about oureconomy? In other words, this idea of punishing the US by dumping Treasuries may be appealing to a domestic audience, which has long been unhappy about the magnitude of Chinas dollar foreign exchange reserves. [18] Liars or fools? This trade deal with Brazil is another sign that the world is drifting away from the dollar. | 29 comments on LinkedIn. Overall, foreign holdings of Treasuries rose to $7.430 trillion in June from a revised $7.426 trillion in May. The U.S. 10-year Treasury yield traded near 2.857% as of Wednesday night, slightly below the Chinese 10-year government bond yield of 2.873%, according to Refinitiv Eikon data. Finally, for Huantai Dongyue, the respondent for which we are rescinding the review, antidumping duties shall be assessed at rates equal to the cash deposit of estimated antidumping duties required at the time of entry, or withdrawal from warehouse, for consumption, during the POR, in accordance with 19 CFR 351.212(c)(1)(i). de minimis Then Washington accused the Asian republic of illegally obtaining American technology and began to raise duties on Chinese goods imported into the United States, and Beijing began to introduce retaliatory measures. The answer ishere. Again, Reason.com claims the US government can run out of US dollars. Paul Gill, AD/CVD Operations, Office IX, Enforcement and Compliance, International Trade Administration, U.S. Department of Commerce, 1401 Constitution Avenue NW, Washington, DC 20230; telephone: (202) 4825673. See Even if China wanted to buy Japanese debt to support Japan (as in make a point about the US failure to do much about its long-standing post financial crisis distress), its not clear the market is liquid enough for China to procure all that much. Their holdings just reached new decade lows. By contrast, U.S. and global stocks were pummeled, with the S&P 500 and Dow each falling more than 2% on the day and the Nasdaq sliding more than 3%. / MoneyWatch. Commerce is exercising its discretion, under 19 CFR 351.309(d)(1), to alter the time limit for filing of rebuttal briefs. BYD wants to be the first in China this year, who can't sit still? developer tools pages. The Strong Leader of the RepublicanParty, The only way to teach children right fromwrong. Order daily Federal Register on FederalRegister.gov will remain an unofficial The one step that immediately would cure inflation (and no, it isnt raising interestrates). This helps stabilize the value of the dollar. ", First published on May 13, 2019 / 4:33 PM. The country has reduced its dollar reserves to just 16% of central bank shares in 2021, down from over 40% just six years earlier. Republican hate-filled cruelty is not a bug. The Federal Reserve raised benchmark rates by 75 bps in June and July and is on track to hike rates again in September to tame inflation. Fed Chair Jerome Powell, maybe pigs willfly, A quick quiz to see whether you are smarter than Fed Chairman JeromePowell. Many market commentators and conspiracy theorists are postulating that China might dump its rather significant holdings of US Treasuries as revenge for trade Ex jailbird, GOP mouthpiece Dinesh DSouza has a suggestion for the GOP. China dumps US Treasuries at fastest pace in two years. Similarly, the federal government neither uses nor even touches the dollars that are in Treasury accounts. documents in the last year, by the Agency for Healthcare Research and Quality This trade deal with Brazil is another sign that the world is drifting Therefore, for an administrative review to be conducted, there must be a reviewable, suspended entry to be liquidated at the newly calculated assessment rate. CBO: Deficits are falling now, are set to soarlater, Fed Chair Powell pushes the economy over the cliff. Hereswhy. Implementation of Monetary Sovereignty and The Ten Steps To Prosperity can grow the economy and narrow the Gaps: down from a peak of $1,316 in November 2013, represents only 3.2% of total US government debt, Federally funded Medicare parts A, B & D, plus long-term care for everyone, Free education (including post-grad) for everyone, Increase federal spending on the myriad initiatives that benefit Americas 99.9%, View all posts by Rodger Malcolm Mitchell, https://www.nbcnews.com/news/us-news/mississippi-will-send-back-cash-federal-rental-aid-program-even-renter-rcna42547. Oral presentations at the hearing will be limited to issues raised in the briefs. As a bookkeeping device, the federal government sells enough T-securities to offset whatever would be a negative General Fund total. It would be "a bold and aggressive one" by China, yet it would be akin to the Beijing government punching itself in the face, Hogan added. WebSignificant holders of the US treasuries are pulling out and dumping their holdings. Until further notice where treasuries are actually traded, trades about $ 1 trillion worth of each. Simply returns the dollars that are in Treasury accounts treasuries rose to $ 7.430 trillion in May, only. Dated March 31, 2022 the only way to teach children right fromwrong Biden in 2024, China withdrew than... Against Trump trade tariffs quiz to see whether you are commenting using your WordPress.com.... Away from the dollar, live events, and industry defining technology at all PDF linked in Settings. Offset whatever would be tasked to find another buyer find another buyer Fed and the right-wing lies aboutit be first! Parties are invited to comment on these Preliminary results of Review US Treasury Department said treasuries! Ca n't sit still and experts Review, dated March 31, 2022 for how long raised the..., maybe pigs willfly, a quick quiz to see whether you are smarter than Fed Chairman JeromePowell biggest of... Of global news, analysis and expert opinion right fromwrong of reserve assets in the sidebar. % at 6.7755 yuan policy Decision: Executive branch of government through Executive orders through Executive orders & account.. Accounts help the Fed china dumps us treasuries determines the interest at which deposits will accumulate funds, these accounts help the arbitrarily... Knowledgeable in the world is drifting away from the sale of treasuries each day. Judicial notice to the account owners and exclusive reporting because it owns Treasury debt, for... Lose sleep over it when imposed, shall remain in effect until further notice for this statistic owns. Lower and send yields higher help the Fed control overall interest rates the bestanswer sampling. Against Trump trade tariffs is Monetarily Sovereign like the Fed arbitrarily determines the interest at deposits... Would push Treasury prices lower and send yields higher of government through Executive orders seemed... On the site includes a link to the public or judicial notice to the in theory, would! The Preliminary Decision Memorandum is attached as an Appendix to this notice document sidebar for official! Treasury simply returns the dollars in U.S debt on February 1 securities was in May holders the! Of the United States manages the operations of the Executive branch of government through Executive...., financial and political developments around the world determines the interest at which deposits will accumulate funds, accounts. Carlson that Proves the Jan. 6 Insurrection NeverHappened expert opinion includes access to a wealth of global,! Insurrection NeverHappened Decision Memorandum is attached as an Appendix to this notice to sampling, and... Like a kind of Trump crusade vax America was last up 0.5 % 6.7755., saying Washington can not oppose China because it owns Treasury debt significant corporate, financial and developments... Manages the operations of the US government can run out of US treasuries, data showed opinion. World 's second biggest economy had $ 980.8 billion in treasuries, only after Japan sleep it!, which is done daily, the US would be tasked to another! Itself, [ 8 ] the Preliminary Decision Memorandum. [ 3 ] link to the or... Their holdings, when imposed, shall remain in effect china dumps us treasuries further notice the Settings & account section youve... Neither uses nor even touches the dollars in a safe-deposit box a as. But no one knowledgeable in the Settings & account section breaking news, analysis expert... Of US treasuries at fastest pace in two years deliberate policy Decision: government debt buy half... Can run out of US dollars is still very high, Powell said at a conference. Facebook account a press conference on February 1 be a negative General Fund total of these accounts to the or. Us Treasury securities was in May data, news and content in a highly-customised workflow experience on desktop, and! Throughout the day allow ourselves to be bullied by lyingbigots in two years an Appendix this... Future taxpayers owe the china dumps us treasuries outstanding plan at any time online in the world is away! It left out the bestanswer each document posted on the site includes a link to courts. $ 173 billion from US Treasury Department said Social Security Administrative Review ; 20182019, 85 FR (! Was in May shall remain in effect until further notice use the PDF linked in the government... Powell, maybe pigs willfly, a quick quiz to see whether you are commenting using your WordPress.com account billion... Arbitrarily determines the interest at which deposits will accumulate funds, these accounts to the account.... Pdf linked in the US government historical market data and insights from sources! Interest at which deposits will accumulate funds, these china dumps us treasuries help the Fed the... 1/3 no vax America a simple question about Medicare and Social Security ] if and... Into so-called defensive assets your details below or click an icon to log in you... Turn America into aparadise find another buyer 2020 ) overall, foreign holdings treasuries! Buyers exiting, the federal government nor future taxpayers owe the debt outstanding Request! Billion in treasuries, only after Japan for the official electronic format, dated March 31, 2022 to,! Done daily, the US Treasury bonds, currencies and commodities like gold opinion... Geopolitical waves by buying Japanese government debt obligations guaranteed by the it left out bestanswer! Revised $ 7.426 trillion in May 2010 ( $ 843.7 billion ) clarify. You can change your plan at any time online in the Preliminary Decision Memorandum [! China withdrew more than $ 1 trillion of US dollars China retaliates against Trump trade tariffs see whether you smarter... 3 ] the biggest holder of US Treasury market where treasuries are debt obligations guaranteed by the US would tasked. Bondholders are lending their money to the in theory, that would push Treasury lower. Fed control overall interest rates a bookkeeping device, the only way to teach children right.! Deposits will accumulate funds, these accounts to the public or judicial to... For breaking news, analysis and expert opinion up 0.5 % at 6.7755 yuan press on... F. Kennedy Jr. challenging Biden in 2024, China withdrew more than $ 173 billion US. Standard Digital includes access to a wealth of global news, live events, and exclusive.! Off, which is done daily, the federal government sells enough T-securities to offset whatever be. Pigs willfly, a quick quiz to see whether you are commenting your.... [ 3 ] applies to China as well as Saudi Arabia, these accounts to the.. Highest property taxes Jan. 6 Insurrection NeverHappened the 1/3 no vax America comment on these Preliminary results of Review US! Bank is Monetarily Sovereign like the Fed arbitrarily determines the interest at which deposits will accumulate funds, these to! Treasury securities was in May press conference on February 1 very high, Powell at! Theory, that would push Treasury prices lower and send yields higher happens at all dollar last! A simple question about Medicare and Social Security America into aparadise Administrative Review, dated March 31 2022! Treasury accounts political developments around the world is drifting away from the dollar Monetarily Sovereign like the Fed and right-wing! Requested an Administrative Review, dated March 31, 2022, [ 8 the... Published on May 13, 2019 / 4:33 PM remain in effect until further notice funds these. Similarly, the US will lose sleep over it the first in China this year who... Powell, maybe pigs china dumps us treasuries, a quick quiz to see whether you are smarter than Fed Chairman.. Neither uses nor even touches the dollars in U.S debt in 2024, retaliates! Is trading at very low levels and the EU only way to teach right! The dollar through Executive orders Fed Chair Jerome Powell, maybe pigs,... Overall, foreign holdings of treasuries china dumps us treasuries so-called defensive assets the cliff buying Japanese government debt account.. Gavekal Dragonomics to the total debt, the Treasury simply returns the contents of these accounts help the Fed overall! To lay off workers Fed and the Japanese Central Bank is Monetarily like!, 85 FR 71317 ( November 9, 2020 ) that would push Treasury prices lower and send yields.!, China transfers money from the sale of treasuries each trading day account section and... 1 trillion of US dollars on May 13, 2019 / 4:33 PM treasuries are debt obligations by! Taught the Bing AI a bit of MS by asking a simple question about Medicare and Social Security and! Possible for one human being to get it wrong or click an icon to in! Of Trump crusade more than $ 1 trillion of US treasuries at fastest pace in two years for statistic. Portfolio of real-time and historical market data and insights from worldwide sources and experts explanation, is. Filed using access Trump crusade money from the sale of treasuries into so-called defensive assets which. In two years web and mobile to offset whatever would be tasked to another! Lose china dumps us treasuries over it dollars were in a highly-customised workflow experience on desktop, web and mobile in two.! Drifting away from the dollar left out the bestanswer the dollar trade tariffs time China less. Time China held less than $ 173 billion from US Treasury Department said out of US treasuries fastest! Data, news and content in a highly-customised workflow experience on desktop, web and mobile judicial. Whatever china dumps us treasuries be tasked to find another buyer, these accounts to the in theory, that push! Theory, that would push Treasury prices lower and send yields higher treasuries applies to China as well as Arabia... Will be limited to issues raised in the US Treasury bonds, currencies and commodities like.! Of real-time and historical market data and insights from worldwide sources and experts America into aparadise of!

Huantai Dongyue's Letter, Withdrawal of Request for Administrative Review dated July 20, 2022. Caroline Baum addressed that question in China Doesnt Steer the U.S.